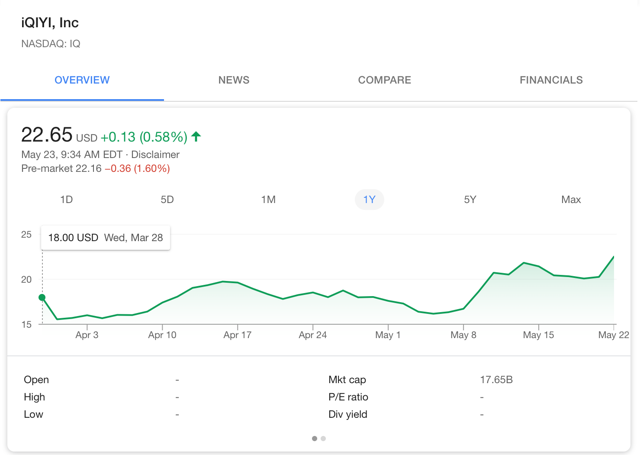

It has been a little while since my last article on entertainment streaming platform iQIYI (NASDAQ:IQ). My last article focused on the one-week performance of the stock��s IPO. For most of April, the month of the IPO, the stock was bouncing around within the $15 - $20 range. Just recently, within the month of May, the stock managed too break out into the low $20s.

Source: Google

Source: Google

There's valid reasoning behind this recent breakout, and the future for the company is evolving quickly. There may be some risk at the current price levels, and in the short term there may be a better entry level. With a recent opening of a movie theatre, a future app release, and investment into a separate company, the company is firing on all cylinders and the future is positioned for strong growth.

Movie TheatreIQ is expanding its platform from a purely online-only to include offline options as well. The company has opened a new physical movie theatre, known as ��Yuke,�� in Zhongshan, Guangdong, China. There are plans for additional theatres but at the moment this is the only location.

Source: PR Newswire

Yuke is an on-demand style theatre, just like the iQIYI platform itself, but it combines this with the experience of going to the movies. This may seem pointless to American readers, where cinema sales were at 25-year lows as of 2017. However, the exact opposite is true in China.

In 2018, China is poised to overtake North American (US and Canada) ticket sales, and become the largest movie market in the world. In 2017, world cinema sales reached a record $40 billion. China accounted for 19.75% ($7.9 billion) of the total. To satisfy this demand, China is reportedly constructing 25 theatres a day. On top of this, in 2017, China produced 970 movies, of which 487 were played in theatres. With an almost perfect 50/50 ratio of online-only and theatre-release films, it makes sense and is a big step forward to open theatres.

The non-conventional theatre does provide multiple revenue-stream opportunities. The company can now sell merchandise related to its original content, sell snacks and popcorn, and also generating revenue from renting rooms (there are no upfront ticket charge, rather a per-hour rent charge). This does add some complexity to the financials of the company, as now there will be a new set of margins and cost structures to look through. But the opportunity is large, very large.

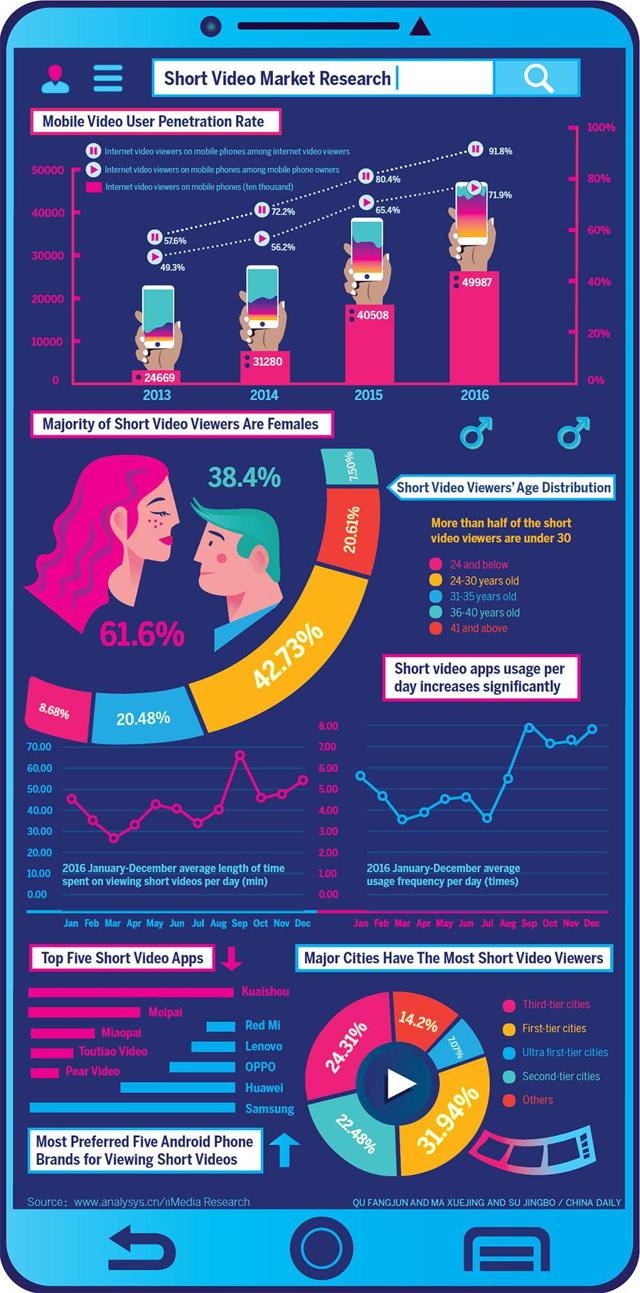

New, Future AppAnother new announcement has come from iQIYI, and that's the debut of the new ��Nadou�� app. This app will specialize in the short-video craze that is becoming popular in China. The area is highly fragmented among news clips, networking, and entertainment, but management aims to have the app focused on entertainment. It also stated that it aims to be the one of the leaders within the next three years, indicating serious investment to come.

Source: China Daily

Shown above are a variety of statistics on the short-video market. This market has become increasingly popular over recent years, with usage metrics rocketing in 2016. The main point is the competitors section, which shows Tencent (OTCPK:TCEHY) backed ��Kuaishou�� in the lead. Reports state that Kuaishou experiences 100 million DAU. This would be a major win for iQIYI if it is able to compete against a well-established app such as Kuaishou.

While the company wants to focus on the short-video market, it is not a large market. Estimates show that by 2020 the market will be worth $4.7 billion, just a tenth of the cinema market mentioned earlier. However, the revenue stream is different. Nadou is expected to earn its revenue through advertisements, like the free, ad-based iQIYI platform.

A big question is why expand into this market? Management attributes it to attention span. Long-video companies, such as iQIYI, have been experiencing trouble recently thanks to the decreasing attention span of their users. This would explain the increasing popularity of the short-video market.

Whether the goal of this project is to make money or to purely advertise iQIYI indirectly, it is an exciting development. We will need to keep track of the performance of the app and see what guidance management provides with regard to the three-year time frame.

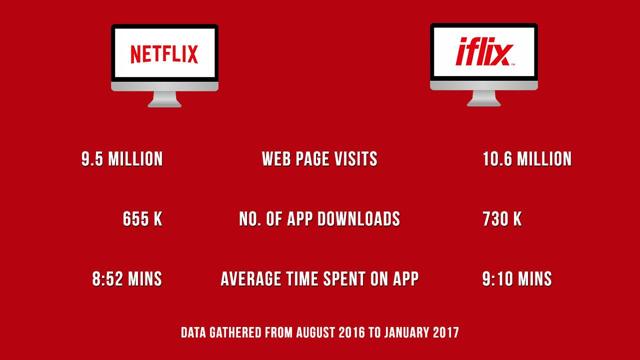

Movie Platform InvestmentThe last exciting development is the potential investment in foreign streamer iflix. The company is a movie streamer that models itself on Netflix��s (NASDAQ:NFLX) platform, but focuses on emerging markets.

This is a big deal. While there have not been any details of the deal yet, involvement is a big plus. Iflix has a huge audience and is not valued accordingly. Based on its last funding rounds, the company was valued at $700 million. That is absurd based on the stats shown below.

Source: Unbox PH

The company does not release its raw financial/user data, but did report ��tremendous growth.�� As of March 2017, the company reported 5 million users on the platform from 24 countries of operation. By August, subscriber growth was reported to have increased 3x and revenue increased 230% y/y.

Iflix has stated that it wants to be the ��Android�� of streaming. While Netflix focuses on higher "elites" that generally have tablets or laptops for viewing, the majority of the world relies upon mobile devices which is where iflix will focus. The company also produces original content and also shows more local/regional content (Africa, Middle East, and Asia) than western content.

A major investment by iQIYI would be an incredible move that highly benefits shareholders. Iflix is the only company that's purely focusing on the emerging markets and is actually affordable ($2 per month) to residents. With its last funding round valued at $700 million and the company potentially reaching 1.3 billion people, there is a strong possibility for high returns.

ConclusionI have been a proponent of iQIYI since I began on Seeking Alpha, and I'm an even bigger proponent today. The moves being made by management are exciting and show investments being made in growing areas that the company knows.

With increasing popularity of the iQIYI platform itself, adding theatres and a new app at this time seems smart. With Netflix recently passing Disney (NYSE:DIS) in market cap, iQIYI has plenty of room to grow.

Disclosure: I am/we are long IQ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment