The benchmark S&P 500 hit a new intra-day record high of 1858.71 before tailing off and closing less than one point shy of its Jan. 15 closing record of 1848.38. Monday's 0.6% gain erased nearly all the 5.8% loss it suffered from mid-January through its Feb. 3 low.

A record close would mark the official end to the 2014 mini-correction and reaffirm that the five-year stock market uptrend remains intact.

The big question now is whether the U.S. stock market is poised to break out to the upside in a style reminiscent of last-year's mega-bullish run — or whether future gains will come more grudgingly.

TRACK YOUR STOCKS: Get real-time quotes with our free Portfolio Tracker

Investors shouldn't expect a repeat of 2013

, says Nick Sargen, chief investment officer at Fort Washington Investment Advisors, whose outlook mimics the current thinking on Wall Street.

"I am a bull, but I'm not in the raging bull camp," says Sargen. "My call is for a higher but choppy year. Not a runaway market."

Market sentiment has taken a 180-degree turn in a three-week span. What changed?

Many of the worries that drove prices down early in the year have subsided.

The emerging-market currency crisis, which hit countries such as Turkey and South Africa, has "cooled off," says Sargen. That reduced fears of a repeat of past crises, including turbulence in the late 1990s that began in Thailand and Russia and spread to the U.S. and other world markets.

Top Information Technology Companies To Buy For 2014

Wall Street also opted to give the sputtering U.S. economy the benefit of the doubt. Investors, citing the ill effects of nasty winter weather, were ! willing to look past weak readings on U.S. home sales, manufacturing and retail sales. They're betting the economy still has enough positive drivers in place to grow at a faster clip this year than last.

Fears that the Federal Reserve's leadership transition from Ben Bernanke to new Chair Janet Yellen could be potentially rocky were put to bed on Feb. 11. Yellen, in testimony to Congress, was able to reassure markets that under her leadership, the Fed will remain supportive of markets.

"The uncertainty regarding Yellen is behind us," says Andy Brooks, head trader at T. Rowe Price.

But if the stock market, which also got a boost from merger activity and better-than-expected fourth-quarter corporate earnings, is to keep rallying, a few things need to happen.

• The economy has to deliver. The data can't remain weak forever; it has to bounce back this spring, says Hugh Johnson, chief investment officer at Hugh Johnson Advisors.

"If we start to get numbers that are consistent with the consensus view that the economy is not only going to get better, but get progressively better, then the picture will change, and the market can move higher," he says.

• New highs must stick. "A healthy market is one where everything is on the same path" and hitting closing highs, says Bruce Bittles, chief investment strategist at R.W. Baird. To confirm a breakout, the S&P 500, the Dow Jones industrials and the Russell 2000 small-stock index must all top their record highs from earlier this year, he says.

• Skepticism must remain. Less optimism is actually bullish, says Price Headley, CEO of investment site BigTrends.com. "The pullback cooled optimism, which is healthy," he says. "I want people to be worried. I want the pullback dialogue to continue."

Getty Images If you managed to claim every possible tax break that you deserved when you filed your return last spring, pat yourself on the back. But don't stop there. Those tax-filing maneuvers were certainly valuable, but you may be able to rack up even bigger savings through thoughtful tax planning all year round. The following ideas could really pay off in the months and years ahead. Give yourself a raise. If you got a big tax refund this year, it meant that you're having too much tax taken out of your paycheck every payday. Filing a new W-4 form with your employer (talk to your payroll office) will insure that you get more of your money when you earn it. If you're just average, you deserve about $225 a month extra. Try our easy withholding calculator now to see if you deserve more allowances. Boost your retirement savings. One of the best ways to lower your tax bill is to reduce your taxable income. You can contribute to up to $17,500 to your 401(k) or similar retirement savings plan in 2010 ($22,000 if you are 50 or older by the end of the year). Money contributed to the plan is not included in your taxable income. Haven't started one yet? Read Why You Need a 401(k) Right Away. Switch to a Roth 401(k). But if you are concerned about skyrocketing taxes in the future, or if you just want to diversify your taxable income in retirement, considering shifting some or all of your retirement plan contributions to a Roth 401(k) if your employer offers one. Unlike the regular 401(k), you don't get a tax break when your money goes into a Roth. On the other hand, money coming out of a Roth 401(k) in retirement will be tax-free, while cash coming out of a regular 401(k) will be taxed in your top bracket. Just remember that you'll have to pay income taxes on the amount you convert. Advertisement Fund an IRA. If you don't have a retirement plan at work, or you want to augment your savings, you can stash money in an IRA. You can contribute up to $5,500 ($6,500 if you are 50 or older by the end of the year). Depending on your income and whether you participate in a retirement savings plan at work, you may be able to deduct some or all of your IRA contribution. Or, you can choose to forgo the upfront tax break and contribute to a Roth IRA that will allow you to take tax-free withdrawals in retirement. Go for a health tax break. Be aggressive if your employer offers a medical reimbursement account -- sometimes called a flex plan. These plans let you divert part of your salary to an account which you can then tap to pay medical bills. The advantage? You avoid both income and Social Security tax on the money, and that can save you 20 percent to 35 percent or more compared with spending after-tax money. The maximum you can contribute to a health care flex plan is $2,500. Pay child-care bills with pre-tax dollars. After taxes, it can easily take $7,500 or more of salary to pay $5,000 worth of child care expenses. But, if you use a child-care reimbursement account at work to pay those bills, you get to use pre-tax dollars. That can save you one-third or more of the cost, since you avoid both income and Social Security taxes. If your boss offers such a plan, take advantage of it. Ask your boss to pay for you to improve yourself. Companies can offer employees up to $5,250 of educational assistance tax-free each year. That means the boss pays the bills but the amount doesn't show up as part of your salary on your W-2. The courses don't even have to be job-related, and even graduate-level courses qualify. Be smart if you're a teacher or aide. Keep receipts for what you spend out of pocket for books, supplies and other classroom materials. You can deduct up to $250 of such out-of-pocket expenses ... even if you don't itemize. Pay back a 401(k) loan before leaving the job. Failing to do so means the loan amount will be considered a distribution that will be taxed in your top bracket and, if you're younger than 55 in the year you leave your job, hit with a 10 percent penalty, too. Tally job-hunting expenses. If you count yourself among the millions of Americans who are unemployed, make sure you keep track of your job-hunting costs. As long as you're looking for a new position in the same line of work (your first job doesn't qualify), you can deduct job-hunting costs including travel expenses such as the cost of food, lodging and transportation, if your search takes you away from home overnight. Such costs are miscellaneous expenses, deductible to the extent all such costs exceed 2 percent of your adjusted gross income. Keep track of the cost of moving to a new job. If the new job is at least 50 miles farther from your old home than your old job was, you can deduct the cost of the move ... even if you don't itemize expenses. If it's your first job, the mileage test is met if the new job is at least 50 miles away from your old home. You can deduct the cost of moving yourself and your belongings. If you drive your own car, you can deduct 24 cents a mile for a 2013 move, plus parking and tolls. If you move in 2014, the rate is 23.5 center a mile. Save energy, save taxes. Congress extended a $500 tax credit for energy-efficient home improvements, such as new windows, doors and skylights, through 2013. Be advised, though, that $500 is the lifetime maximum, so if you claimed $500 in energy-efficient credits before this year, you can't claim this credit. There are also restrictions on specific projects; for example, the maximum you can claim for new energy-efficient windows is $200. Think green. A separate tax credit is available for homeowners who install alternative energy equipment. It equals 30 percent of what a homeowner spends on qualifying property such as solar electric systems, solar hot water heaters, geothermal heat pumps, and wind turbines, including labor costs. There is no cap on this tax credit, which is available through 2016. Put away your checkbook. If you plan to make a significant gift to charity, consider giving appreciated stocks or mutual fund shares that you've owned for more than one year instead of cash. Doing so supercharges the saving power of your generosity. Your charitable contribution deduction is the fair market value of the securities on the date of the gift, not the amount you paid for the asset, and you never have to pay tax on the profit. However, don't donate stocks or fund shares that lost money. You'd be better off selling the asset, claiming the loss on your taxes, and donating cash to the charity. Tote up out-of-pocket costs of doing good. Keep track of what you spend while doing charitable work, from what you spend on stamps for a fundraiser, to the cost of ingredients for casseroles you make for the homeless, to the number of miles you drive your car for charity (at 14 cents a mile). Add such costs with your cash contributions when figuring your charitable contribution deduction. Time your wedding. If you're planning a wedding near year-end, put the romance aside for a moment to consider the tax consequences. The tax law still includes a "marriage penalty" that forces some pairs to pay more combined tax as a married couple than as singles. For others, tying the knot saves on taxes. Consider whether Uncle Sam would prefer a December or January ceremony. And, whether you have one job between you or two or more, revise withholding at work to reflect the tax bill you'll owe as a couple. Beware of Uncle Sam's interest in your divorce. Watch the tax basis -- that is, the value from which gains or losses will be determined when property is sold -- when working toward an equitable property settlement. One $100,000 asset might be worth a lot more -- or a lot less -- than another, after the IRS gets its share. Remember: Alimony is deductible by the payer and taxable income to the recipient; a property settlement is neither deductible nor taxable. The stork brings tax savings, too. A child born, or adopted, is a blessed event for your tax return. An added dependency exemption will knock $3,950 off your taxable income, and you'll probably qualify for the $1,000 child credit, too. You don't have to wait until you file your return to reap the benefit. Add at least one extra withholding allowance to the W-4 form filed with your employer to cut tax withholding from your paycheck. That will immediately increase your take-home pay.

Getty Images If you managed to claim every possible tax break that you deserved when you filed your return last spring, pat yourself on the back. But don't stop there. Those tax-filing maneuvers were certainly valuable, but you may be able to rack up even bigger savings through thoughtful tax planning all year round. The following ideas could really pay off in the months and years ahead. Give yourself a raise. If you got a big tax refund this year, it meant that you're having too much tax taken out of your paycheck every payday. Filing a new W-4 form with your employer (talk to your payroll office) will insure that you get more of your money when you earn it. If you're just average, you deserve about $225 a month extra. Try our easy withholding calculator now to see if you deserve more allowances. Boost your retirement savings. One of the best ways to lower your tax bill is to reduce your taxable income. You can contribute to up to $17,500 to your 401(k) or similar retirement savings plan in 2010 ($22,000 if you are 50 or older by the end of the year). Money contributed to the plan is not included in your taxable income. Haven't started one yet? Read Why You Need a 401(k) Right Away. Switch to a Roth 401(k). But if you are concerned about skyrocketing taxes in the future, or if you just want to diversify your taxable income in retirement, considering shifting some or all of your retirement plan contributions to a Roth 401(k) if your employer offers one. Unlike the regular 401(k), you don't get a tax break when your money goes into a Roth. On the other hand, money coming out of a Roth 401(k) in retirement will be tax-free, while cash coming out of a regular 401(k) will be taxed in your top bracket. Just remember that you'll have to pay income taxes on the amount you convert. Advertisement Fund an IRA. If you don't have a retirement plan at work, or you want to augment your savings, you can stash money in an IRA. You can contribute up to $5,500 ($6,500 if you are 50 or older by the end of the year). Depending on your income and whether you participate in a retirement savings plan at work, you may be able to deduct some or all of your IRA contribution. Or, you can choose to forgo the upfront tax break and contribute to a Roth IRA that will allow you to take tax-free withdrawals in retirement. Go for a health tax break. Be aggressive if your employer offers a medical reimbursement account -- sometimes called a flex plan. These plans let you divert part of your salary to an account which you can then tap to pay medical bills. The advantage? You avoid both income and Social Security tax on the money, and that can save you 20 percent to 35 percent or more compared with spending after-tax money. The maximum you can contribute to a health care flex plan is $2,500. Pay child-care bills with pre-tax dollars. After taxes, it can easily take $7,500 or more of salary to pay $5,000 worth of child care expenses. But, if you use a child-care reimbursement account at work to pay those bills, you get to use pre-tax dollars. That can save you one-third or more of the cost, since you avoid both income and Social Security taxes. If your boss offers such a plan, take advantage of it. Ask your boss to pay for you to improve yourself. Companies can offer employees up to $5,250 of educational assistance tax-free each year. That means the boss pays the bills but the amount doesn't show up as part of your salary on your W-2. The courses don't even have to be job-related, and even graduate-level courses qualify. Be smart if you're a teacher or aide. Keep receipts for what you spend out of pocket for books, supplies and other classroom materials. You can deduct up to $250 of such out-of-pocket expenses ... even if you don't itemize. Pay back a 401(k) loan before leaving the job. Failing to do so means the loan amount will be considered a distribution that will be taxed in your top bracket and, if you're younger than 55 in the year you leave your job, hit with a 10 percent penalty, too. Tally job-hunting expenses. If you count yourself among the millions of Americans who are unemployed, make sure you keep track of your job-hunting costs. As long as you're looking for a new position in the same line of work (your first job doesn't qualify), you can deduct job-hunting costs including travel expenses such as the cost of food, lodging and transportation, if your search takes you away from home overnight. Such costs are miscellaneous expenses, deductible to the extent all such costs exceed 2 percent of your adjusted gross income. Keep track of the cost of moving to a new job. If the new job is at least 50 miles farther from your old home than your old job was, you can deduct the cost of the move ... even if you don't itemize expenses. If it's your first job, the mileage test is met if the new job is at least 50 miles away from your old home. You can deduct the cost of moving yourself and your belongings. If you drive your own car, you can deduct 24 cents a mile for a 2013 move, plus parking and tolls. If you move in 2014, the rate is 23.5 center a mile. Save energy, save taxes. Congress extended a $500 tax credit for energy-efficient home improvements, such as new windows, doors and skylights, through 2013. Be advised, though, that $500 is the lifetime maximum, so if you claimed $500 in energy-efficient credits before this year, you can't claim this credit. There are also restrictions on specific projects; for example, the maximum you can claim for new energy-efficient windows is $200. Think green. A separate tax credit is available for homeowners who install alternative energy equipment. It equals 30 percent of what a homeowner spends on qualifying property such as solar electric systems, solar hot water heaters, geothermal heat pumps, and wind turbines, including labor costs. There is no cap on this tax credit, which is available through 2016. Put away your checkbook. If you plan to make a significant gift to charity, consider giving appreciated stocks or mutual fund shares that you've owned for more than one year instead of cash. Doing so supercharges the saving power of your generosity. Your charitable contribution deduction is the fair market value of the securities on the date of the gift, not the amount you paid for the asset, and you never have to pay tax on the profit. However, don't donate stocks or fund shares that lost money. You'd be better off selling the asset, claiming the loss on your taxes, and donating cash to the charity. Tote up out-of-pocket costs of doing good. Keep track of what you spend while doing charitable work, from what you spend on stamps for a fundraiser, to the cost of ingredients for casseroles you make for the homeless, to the number of miles you drive your car for charity (at 14 cents a mile). Add such costs with your cash contributions when figuring your charitable contribution deduction. Time your wedding. If you're planning a wedding near year-end, put the romance aside for a moment to consider the tax consequences. The tax law still includes a "marriage penalty" that forces some pairs to pay more combined tax as a married couple than as singles. For others, tying the knot saves on taxes. Consider whether Uncle Sam would prefer a December or January ceremony. And, whether you have one job between you or two or more, revise withholding at work to reflect the tax bill you'll owe as a couple. Beware of Uncle Sam's interest in your divorce. Watch the tax basis -- that is, the value from which gains or losses will be determined when property is sold -- when working toward an equitable property settlement. One $100,000 asset might be worth a lot more -- or a lot less -- than another, after the IRS gets its share. Remember: Alimony is deductible by the payer and taxable income to the recipient; a property settlement is neither deductible nor taxable. The stork brings tax savings, too. A child born, or adopted, is a blessed event for your tax return. An added dependency exemption will knock $3,950 off your taxable income, and you'll probably qualify for the $1,000 child credit, too. You don't have to wait until you file your return to reap the benefit. Add at least one extra withholding allowance to the W-4 form filed with your employer to cut tax withholding from your paycheck. That will immediately increase your take-home pay.

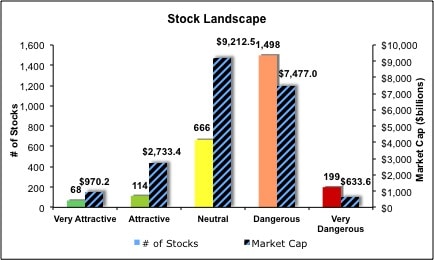

Source: New Constructs, LLC.

Source: New Constructs, LLC. Source: New Constructs, LLC.

Source: New Constructs, LLC.