Monday, April 1, 2019

Wells Fargo CEO Out, Stock Rises

Sunday, March 31, 2019

Stocks making the biggest moves premarket: McDonald's, Facebook, Mastercard, Tesla, Nike & more

Check out the companies making headlines before the bell:

McDonald's — McDonald's is buying Israeli marketing technology firm Dynamic Yield for a reported $300 million, in a move to modernize its drive through menu displays and mobile ordering. The acquisition is the largest for the fast-food giant in two decades.

Facebook — Facebook said it had removed more accounts from Iran, Russia, Macedonia, and Kosovo due to what it calls "coordinated inauthentic behavior."

Mastercard — Mastercard is investing nearly $300 million in the London initial public offering of Dubai-based payments processor Network International, the large such company in the Middle East and Africa.

Tesla — The automaker and CEO Elon Musk have won a second dismissal of a securities fraud lawsuit alleging that misleading comments were made about Model 3 production. The suit had originally been dismissed in October 2017 but the judge in the case allowed the plaintiffs to file an amended suit.

Bed Bath & Beyond — Bed Bath & Beyond is the target of activist funds Legion Partners Asset Management, Macellum Advisors, and Ancora Advisors. The three have a combined five percent stake in the housewares retailer and plan to launch a proxy fight to replace the retailer's entire board, according to The Wall Street Journal.

Nvidia — Piper Jaffray began coverage of the graphics chipmaker with an "overweight" rating, saying the stock is trading at attractive levels and that Nvidia is positioned to overcome some industry headwinds.

Nike — Nike shares remain on watch after a volatile Monday session in which attorney Michael Avenatti said he would be unveiling a scandal involving the athletic footwear and apparel maker. Following that announcement, Avenatti was arrested on charges of alleged extortion.

McCormick — The spice maker earned an adjusted $1.12 per share for its latest quarter, beating estimates by 3 cents a share. Revenue was in line with Wall Street forecasts. Consumer business sales were on the lighter side, but that was offset by a strong performance in flavor solutions.

IHS Markit — The analytics and financial information company beat estimate by 3 cents a share, with adjusted quarterly profit of 60 cents per share. Revenue fell short of forecasts, however, but HIS Markit reaffirmed its full-year guidance.

FactSet — The financial information software provider reported adjusted quarterly profit of $2.42 per share, 9 cents a share above consensus estimates. Revenue missed Wall Street forecasts. FactSet also boosted the lower end of its fiscal-year outlook, seeing full-year adjusted earnings of $9.50 to $9.65 per share, compared to a consensus estimate of $9.55 a share.

Conn's — The home appliances and furniture retailer reported adjusted quarterly profit of 96 cents per share, 20 cents a share above estimates. Comparable-store sales fell 1.4 percent, however, and revenue came in below Wall Street forecasts.

CORRECTION: This article has been updated to show that Mastercard is investing nearly $300 million in the London initial public offering of Dubai-based payments processor Network International.

Thursday, March 28, 2019

Movers & Shakers: Sandhar Tech, GMR Infra, Phoenix Mills and PVR

The Indian benchmark indices have showed some robust gains in afternoon session with Nifty up 128 points, trading at 11,482 whereas Sensex zoomed 417 points, trading at 38,225.

The breadth of the market favoured the advances with 1376 stocks advancing and 1271 declining while 161 remained unchanged on the BSE.

Below are the stocks which moved the most with respect to volumes:

Sandhar Technologies was trading with volumes of 101,544 shares, compared to its five day average of 1,123 shares, an increase of 8,940.60 percent. The stock witnessed spurt in volume by more than 92.65 times.

related news HCC zooms 8% on board approval for monetisation of specified awards & claims D-Street Buzz: Nifty PSU Bank surges led by SBI, RIL also up; TechM falls 2%Phoenix Mills was trading with volumes of 73,877 shares, compared to its five day average of 2,309 shares, an increase of 3,099.80 percent. The stock saw spurt in volume by more than 39.11 times.

Saregama India was trading with volumes of 50,769 shares, compared to its five day average of 2,009 shares, an increase of 2,426.58 percent. The stock saw spurt in volume by more than 27.55 times.

PVR was trading with volumes of 336,903 shares, compared to its five day average of 27,689 shares, an increase of 1,116.72 percent. The stock saw spurt in volume by more than 12.93 times.

Speciality Restaurants was trading with volumes of 92,955 shares, compared to its five day average of 8,473 shares, an increase of 997.07 percent. The stock witnessed spurt in volume by more than 8.41 times.

GMR Infrastructure was trading with volumes of 11,616,886 shares, compared to its five day average of 1,136,111 shares, an increase of 922.51 percent. It saw spurt in volume by more than 12.34 times.

United Breweries was trading with volumes of 127,679 shares, compared to its five day average of 18,529 shares, an increase of 589.09 percent. The stock witnessed spurt in volume by more than 6.33 times. First Published on Mar 26, 2019 03:25 pmSunday, March 24, 2019

Top 10 Medical Stocks To Watch For 2019

No matter your stage of life, there's a good chance healthcare constitutes one of your most significant expenses. And if you're struggling to keep up with it, you're not alone. Medical debt is actually the No. 1 source of personal bankruptcy filings in the country, and even folks with decent insurance often find themselves in way over their heads.

But while certain medical costs are indeed unavoidable, in many cases, we do have the power to lower our healthcare spending. Here are a few reasons why you might be paying more for medical care than necessary, and what you can do about it.

IMAGE SOURCE: GETTY IMAGES.

1. You're not buying prescriptions in bulkIf there are medications you take regularly, you'll generally come out way ahead by buying them in bulk rather than renewing month after month. In fact, in some cases, you may come to find that a 90-day supply of pills is actually cheaper than a 30-day supply. It pays to ask your provider for 90-day prescriptions whenever they're available, because they could save you not only money, but time.

Top 10 Medical Stocks To Watch For 2019: Reaves Utility Income Fund(UTG)

Advisors' Opinion:- [By Stephan Byrd]

Liberum Capital restated their buy rating on shares of UNITE Group (LON:UTG) in a research note released on Friday morning.

UTG has been the topic of a number of other reports. Peel Hunt restated a buy rating and issued a GBX 870 ($11.58) price target on shares of UNITE Group in a research report on Tuesday, February 27th. Morgan Stanley raised their price target on shares of UNITE Group from GBX 710 ($9.45) to GBX 850 ($11.32) and gave the stock an equal weight rating in a research report on Tuesday, March 13th. Numis Securities restated a restricted rating and issued a GBX 892 ($11.88) price target on shares of UNITE Group in a research report on Wednesday, February 21st. Finally, JPMorgan Chase & Co. raised their price target on shares of UNITE Group from GBX 850 ($11.32) to GBX 900 ($11.98) and gave the stock a neutral rating in a research report on Wednesday, March 7th. Three equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company’s stock. The stock presently has an average rating of Hold and an average price target of GBX 862.83 ($11.49).

- [By Ethan Ryder]

Shares of UNITE Group plc (LON:UTG) have been given a consensus rating of “Hold” by the six brokerages that are covering the firm, Marketbeat.com reports. Four analysts have rated the stock with a hold recommendation and two have given a buy recommendation to the company. The average 12 month price target among brokers that have issued ratings on the stock in the last year is GBX 878.75 ($11.45).

- [By ]

Or they can opt for a closed-end fund (CEF), like Wells Fargo Utilities and High Income Fund (NYSE: ERH) or Reaves Utility Income Fund (NYSE: UTG). Both deliver yields much higher than the 3.6% yield of XLU. Most recently, ERH was yielding 7.2% and UTG was yielding 6.7% thanks to the use of leverage.

Top 10 Medical Stocks To Watch For 2019: Orchid Island Capital, Inc.(ORC)

Advisors' Opinion:- [By Joseph Griffin]

ValuEngine upgraded shares of Orchid Island Capital (NYSE:ORC) from a strong sell rating to a sell rating in a report issued on Thursday.

Separately, Zacks Investment Research downgraded Orchid Island Capital from a buy rating to a hold rating in a report on Tuesday, July 3rd.

- [By Shane Hupp]

One Liberty Properties (NYSE: ORC) and Orchid Island Capital (NYSE:ORC) are both small-cap finance companies, but which is the superior business? We will contrast the two businesses based on the strength of their institutional ownership, analyst recommendations, earnings, valuation, profitability, risk and dividends.

- [By Paul Ausick]

Orchid Island Capital Inc. (NYSE: ORC) fell about 9.7% to post a new 52-week low of $7.85 Thursday after closing at $8.69 on Wednesday. The 52-week high is $12.60. Volume of about 5.2 million was nearly 5 times the daily average of around 1.1 million. The company lowered its monthly dividend by 3 cents last night.

- [By Logan Wallace]

Orchid Island Capital (NYSE: ORC) and Alexandria Real Estate Equities (NYSE:ARE) are both finance companies, but which is the superior business? We will contrast the two businesses based on the strength of their institutional ownership, risk, profitability, analyst recommendations, valuation, earnings and dividends.

- [By Motley Fool Transcribers]

Orchid Island Capital, Inc. (NYSE:ORC)Q4 2018 Earnings Conference CallFeb. 22, 2019, 10:00 a.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:Operator

- [By Shane Hupp]

AmeriCold Realty Trust (NYSE: ORC) and Orchid Island Capital (NYSE:ORC) are both finance companies, but which is the better business? We will contrast the two businesses based on the strength of their dividends, analyst recommendations, earnings, institutional ownership, risk, profitability and valuation.

Top 10 Medical Stocks To Watch For 2019: StoneMor Partners L.P.(STON)

Advisors' Opinion:- [By WWW.GURUFOCUS.COM]

For the details of AXAR CAPITAL MANAGEMENT L.P.'s stock buys and sells, go to http://www.gurufocus.com/StockBuy.php?GuruName=AXAR+CAPITAL+MANAGEMENT+L.P.

These are the top 5 holdings of AXAR CAPITAL MANAGEMENT L.P.Stonemor Partners LP (STON) - 6,650,613 shares, 68.21% of the total portfolio. Shares added by 8.91%Patterson-UTI Energy Inc (PTEN) - 730,000 shares, 21.11% of the total portfolio. Stage Stores Inc (SSI) - 1,750,000 shares, 6.3% of the total portfolio. Shares added by 75.00%Five Star Senior Living Inc (FVE) - 2,039,878 shares, 4.38% of the total portfolio. Added - [By Ethan Ryder]

StoneMor Partners L.P. (NYSE:STON) major shareholder Axar Capital Management L.P. bought 24,900 shares of the firm’s stock in a transaction on Wednesday, February 13th. The stock was acquired at an average cost of $3.36 per share, with a total value of $83,664.00. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Large shareholders that own 10% or more of a company’s stock are required to disclose their transactions with the SEC.

- [By WWW.GURUFOCUS.COM]

For the details of AXAR CAPITAL MANAGEMENT L.P.'s stock buys and sells, go to https://www.gurufocus.com/guru/axar+capital+management+l.p./current-portfolio/portfolio

These are the top 5 holdings of AXAR CAPITAL MANAGEMENT L.P.SPDR S&P 500 (SPY) - 1,220,000 shares, 91.31% of the total portfolio. Stonemor Partners LP (STON) - 7,384,970 shares, 4.64% of the total portfolio. Shares added by 7.35%Patterson-UTI Energy Inc (PTEN) - 730,000 shares, 2.26% of the total portfolio. Independence Contract Drilling Inc (ICD) - 969,662 shares, 0.91% of the total portfolio. New PositionStage Stores Inc (SSI) - 3,700,000 shares, 0.82% of the total portfolio. Shares added by 6 - [By WWW.GURUFOCUS.COM]

For the details of AXAR CAPITAL MANAGEMENT L.P.'s stock buys and sells, go to https://www.gurufocus.com/guru/axar+capital+management+l.p./current-portfolio/portfolio

These are the top 5 holdings of AXAR CAPITAL MANAGEMENT L.P.SPDR S&P 500 (SPY) - 1,220,000 shares, 91.31% of the total portfolio. Stonemor Partners LP (STON) - 7,384,970 shares, 4.64% of the total portfolio. Shares added by 7.35%Patterson-UTI Energy Inc (PTEN) - 730,000 shares, 2.26% of the total portfolio. Independence Contract Drilling Inc (ICD) - 969,662 shares, 0.91% of the total portfolio. New PositionStage Stores Inc (SSI) - 3,700,000 shares, 0.82% of the total portfolio. Shares added by 6 - [By Joseph Griffin]

StoneMor Partners L.P. (NYSE:STON) major shareholder Axar Capital Management L.P. purchased 6,420 shares of StoneMor Partners stock in a transaction that occurred on Monday, September 17th. The shares were purchased at an average cost of $4.34 per share, with a total value of $27,862.80. The acquisition was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Large shareholders that own 10% or more of a company’s stock are required to disclose their sales and purchases with the SEC.

- [By WWW.GURUFOCUS.COM]

For the details of AXAR CAPITAL MANAGEMENT L.P.'s stock buys and sells, go to https://www.gurufocus.com/guru/axar+capital+management+l.p./current-portfolio/portfolio

These are the top 5 holdings of AXAR CAPITAL MANAGEMENT L.P.SPDR S&P 500 (SPY) - 1,220,000 shares, 91.31% of the total portfolio. Stonemor Partners LP (STON) - 7,384,970 shares, 4.64% of the total portfolio. Shares added by 7.35%Patterson-UTI Energy Inc (PTEN) - 730,000 shares, 2.26% of the total portfolio. Independence Contract Drilling Inc (ICD) - 969,662 shares, 0.91% of the total portfolio. New PositionStage Stores Inc (SSI) - 3,700,000 shares, 0.82% of the total portfolio. Shares added by 6

Top 10 Medical Stocks To Watch For 2019: LiqTech International, Inc.(LIQT)

Advisors' Opinion:- [By Money Morning Staff Reports]

However, it's unlikely Netlist repeats these returns anytime soon. After looking at last week's top performing penny stocks, we'll show you a penny stock on the verge of jumping over 230%…

Penny Stock Current Share Price Last Week's Gain Netlist Inc. (Nasdaq: NLST) $0.83 542.67% Mannkind Corp. (Nasdaq: MNKD) $1.80 79.09% Fred's Inc. (Nasdaq: FRED) $2.49 73.68% Delcath Systems Inc. (OTCMKTS: DCTH) $3.70 72.63% Gemphire Therapeutics Inc. (Nasdaq: GEMP) $1.96 50.71% Bellerophon Therapeutics Inc. (Nasdaq: BLPH) $1.05 47.98% Cel-Sci Corp. (NYSE: CVM) $3.78 44.78% ParkerVision Inc. (OTCMKTS: PRKR) $0.60 29.42% Superior Drilling Products Inc. (NYSE: SDPI) $2.63 29.23% LiqTech International Inc. (NYSE: LIQT) $1.50 25.20%How to Profit off This $11.1 Billion Money Pool: By following a few simple steps, one IRS directive could help set you up to receive checks of up to $1,795 every single month thanks to a genius investment. Learn more…

- [By Lisa Levin] Gainers Red Violet, Inc. (NASDAQ: RDVT) rose 75.31 percent to close at $9.94 after reporting Q1 results. Euro Tech Holdings Company Limited (NASDAQ: CLWT) shares jumped 40.62 percent to close at $4.50 on Tuesday after reporting 2017 year-end results. MEI Pharma, Inc. (NASDAQ: MEIP) gained 34.39 percent to close at $3.40. MEDIGUS Ltd/S ADR (NASDAQ: MDGS) gained 32.74 percent to close at $1.50 in reaction to its Monday announcement of a distribution agreement. The medical device company said it reached an agreement to distribute its minimally invasive medical devices in Turkey, Azerbaijan and Georgia. Pfenex Inc. (NYSE: PFNX) surged 31.15 percent to close at $8.00 after the company announced the positive top-line PF708 study results in Osteoporosis patients that showed no imbalances in severity or incidence of adverse events. Arcadia Biosciences, Inc. (NASDAQ: RKDA) rose 21.07 percent to close at $11.09. Arcadia Biosciences reported that Albert D. Bolles, Ph.D. has joined its board of directors. Genprex, Inc. (NASDAQ: GNPX) rose 20.23 percent to close at $10.58. Turtle Beach Corporation (NASDAQ: HEAR) shares gained 17.62 percent to close at $17.82. Aptevo Therapeutics Inc. (NASDAQ: APVO) rose 17.1 percent to close at $5.82. Phoenix New Media Limited (NYSE: FENG) shares jumped 16.23 percent to close at $4.87 following Q1 earnings. Stein Mart, Inc. (NASDAQ: SMRT) rose 16.04 percent to close at $3.69. PPDAI Group Inc. (NASDAQ: PPDF) climbed 15.99 percent to close at $7.98 following Q1 results. Tyme Technologies, Inc. (NASDAQ: TYME) rose 15.93 percent to close at $3.42. LiqTech International, Inc. (NASDAQ: LIQT) gained 15.59 percent to close at $0.5532 following Q1 results. Sophiris Bio, Inc. (NASDAQ: SPHS) gained 13.92 percent to close at $3.52 on Tuesday following Q1 results. Euroseas Ltd. (NASDAQ: ESEA) jumped 13.4 percent to close at $2.37. Iteris, Inc. (NASDAQ: ITI) shares surged 13.05 percent to close

- [By Money Morning Staff Reports]

But Blink and our other penny stocks to watch are unlikely to continue to lock in such spectacular gains in June. After looking at our 10 top penny stocks to watch this month, we'll show you a small-cap stock with great profit potential in its future…

Penny Stock Current Share Price Law Month's Gain Blink Charging Co. (Nasdaq: BLNK) $7.07 439.85% Senes Tech Inc. (Nasdaq: SNES) $1.27 175.40% Vivis Inc. (Nasdaq: VVUS) $0.77 150.41% Adomani Inc. (Nasdaq: ADOM) $1.49 137.68% NF Energy Saving Co. (Nasdaq: NFEC) $2.34 134.88% Vaalco Energy Inc. (NYSE: EGY) $2.15 109.06% Heat Biologics Inc. (Nasdaq: HTBX) $2.35 99.12% ArQule Inc. (Nasdaq: ARQL) $4.88 90.74% LiqTech International Inc. (NYSE: LIQT) $0.66 85.60% Transenterix Inc. (NYSE: TRXC) $3.46 77.84%While last month's gains are tremendous, they also illustrate the inherent dangers that come with investing in penny stocks.

- [By Logan Wallace]

LiqTech International Inc (NYSEAMERICAN:LIQT) shares rose 11.2% during mid-day trading on Wednesday . The company traded as high as $0.94 and last traded at $0.91. Approximately 1,268,573 shares were traded during mid-day trading, an increase of 253% from the average daily volume of 359,292 shares. The stock had previously closed at $0.82.

Top 10 Medical Stocks To Watch For 2019: Credo Petroleum Corporation(CRED)

Advisors' Opinion:- [By Stephan Byrd]

Verify (CURRENCY:CRED) traded up 16.6% against the US dollar during the 24 hour period ending at 22:00 PM Eastern on July 3rd. Verify has a total market capitalization of $1.20 million and $2,751.00 worth of Verify was traded on exchanges in the last day. One Verify token can currently be bought for approximately $0.0885 or 0.00001370 BTC on major cryptocurrency exchanges including EtherDelta (ForkDelta), COSS, CoinFalcon and YoBit. In the last seven days, Verify has traded 27.1% higher against the US dollar.

- [By Joseph Griffin]

News coverage about iShares U.S. Credit Bond ETF (NASDAQ:CRED) has trended positive recently, according to Accern Sentiment Analysis. Accern identifies negative and positive press coverage by monitoring more than 20 million news and blog sources in real time. Accern ranks coverage of public companies on a scale of -1 to 1, with scores closest to one being the most favorable. iShares U.S. Credit Bond ETF earned a coverage optimism score of 0.36 on Accern’s scale. Accern also gave media coverage about the company an impact score of 44.0180461435892 out of 100, meaning that recent press coverage is somewhat unlikely to have an effect on the company’s share price in the near term.

- [By Shane Hupp]

Sawtooth Solutions LLC boosted its holdings in shares of iShares Core U.S. Credit Bond ETF (NASDAQ:CRED) by 24.1% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 230,300 shares of the company’s stock after purchasing an additional 44,773 shares during the quarter. iShares Core U.S. Credit Bond ETF makes up 2.2% of Sawtooth Solutions LLC’s holdings, making the stock its 10th largest position. Sawtooth Solutions LLC’s holdings in iShares Core U.S. Credit Bond ETF were worth $25,096,000 as of its most recent SEC filing.

- [By Logan Wallace]

Verify (CURRENCY:CRED) traded down 14.9% against the U.S. dollar during the one day period ending at 17:00 PM Eastern on October 1st. During the last week, Verify has traded up 12.9% against the U.S. dollar. One Verify token can now be bought for about $0.0690 or 0.00001051 BTC on popular exchanges including IDEX, Radar Relay, YoBit and COSS. Verify has a market cap of $931,609.00 and approximately $24.00 worth of Verify was traded on exchanges in the last day.

Top 10 Medical Stocks To Watch For 2019: Intercontinental Exchange Inc.(ICE)

Advisors' Opinion:- [By Logan Wallace]

iDice (CURRENCY:ICE) traded down 3.3% against the U.S. dollar during the 24-hour period ending at 21:00 PM E.T. on April 20th. iDice has a total market cap of $85,719.00 and approximately $0.00 worth of iDice was traded on exchanges in the last 24 hours. Over the last seven days, iDice has traded 21.8% higher against the U.S. dollar. One iDice token can currently be bought for about $0.0546 or 0.00000680 BTC on exchanges including CoinExchange and Mercatox.

- [By Paul Ausick]

The Intercontinental Exchange Inc. (NYSE: ICE) announced plans Tuesday to launch a Permian West Texas Intermediate (WTI) crude oil futures contract with delivery in Houston. The contract is expected to launch this quarter on the ICE U.S. Futures once it receives regulatory approval.

- [By Shane Hupp]

Castle Rock Wealth Management LLC purchased a new stake in Intercontinental Exchange Inc (NYSE:ICE) in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 5,153 shares of the financial services provider’s stock, valued at approximately $379,000.

Top 10 Medical Stocks To Watch For 2019: SmartFinancial, Inc.(SMBK)

Advisors' Opinion:- [By Stephan Byrd]

Media coverage about SmartFinancial (NASDAQ:SMBK) has been trending somewhat positive this week, Accern Sentiment reports. The research group ranks the sentiment of news coverage by monitoring more than twenty million blog and news sources in real-time. Accern ranks coverage of public companies on a scale of negative one to positive one, with scores closest to one being the most favorable. SmartFinancial earned a coverage optimism score of 0.16 on Accern’s scale. Accern also assigned news stories about the bank an impact score of 45.289677526379 out of 100, indicating that recent news coverage is somewhat unlikely to have an effect on the company’s share price in the next several days.

- [By Ethan Ryder]

SmartFinancial (NASDAQ:SMBK) was downgraded by equities research analysts at BidaskClub from a “strong-buy” rating to a “buy” rating in a report released on Friday.

- [By Logan Wallace]

News coverage about SmartFinancial (NASDAQ:SMBK) has been trending somewhat positive recently, Accern reports. Accern scores the sentiment of news coverage by analyzing more than 20 million news and blog sources in real-time. Accern ranks coverage of public companies on a scale of negative one to positive one, with scores nearest to one being the most favorable. SmartFinancial earned a news impact score of 0.21 on Accern’s scale. Accern also assigned media headlines about the bank an impact score of 45.2295427650778 out of 100, indicating that recent news coverage is somewhat unlikely to have an effect on the stock’s share price in the near term.

- [By Joseph Griffin]

Get a free copy of the Zacks research report on SmartFinancial (SMBK)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Max Byerly]

BidaskClub lowered shares of SmartFinancial (NASDAQ:SMBK) from a hold rating to a sell rating in a research note published on Thursday morning.

A number of other analysts have also weighed in on SMBK. Zacks Investment Research upgraded SmartFinancial from a sell rating to a buy rating and set a $21.00 target price on the stock in a research note on Wednesday, January 16th. FIG Partners began coverage on SmartFinancial in a report on Friday, February 22nd. They issued an outperform rating for the company. Two analysts have rated the stock with a sell rating, three have assigned a hold rating and three have assigned a buy rating to the stock. The company has an average rating of Hold and an average price target of $24.60.

Top 10 Medical Stocks To Watch For 2019: Superior Industries International Inc.(SUP)

Advisors' Opinion:- [By Shane Hupp]

Superior Coin (SUP) uses the hashing algorithm. It was first traded on February 19th, 2015. Superior Coin’s total supply is 385,720,236 coins. Superior Coin’s official Twitter account is @superiorcoins. The official website for Superior Coin is superior-coin.com.

- [By Max Byerly]

Get a free copy of the Zacks research report on Superior Industries International (SUP)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Stephan Byrd]

Get a free copy of the Zacks research report on Superior Industries International (SUP)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Shane Hupp]

Here are some of the news articles that may have impacted Accern Sentiment Analysis’s rankings:

Get Superior Industries International alerts: Brokerages Anticipate Superior Industries International, Inc. (SUP) to Post $0.18 EPS (americanbankingnews.com) Superior and Mimico create NZ partnership (khl.com) Superior Industries Rides On Volumes & UNIWHEELS Buyout (zacks.com) Superior Industries International (SUP) Upgraded to Buy by Zacks Investment Research (americanbankingnews.com) B. Riley Research Analysts Raise Earnings Estimates for Superior Industries International, Inc. (SUP) (americanbankingnews.com)Superior Industries International stock opened at $17.25 on Friday. The company has a debt-to-equity ratio of 1.43, a quick ratio of 1.27 and a current ratio of 2.15. Superior Industries International has a 12 month low of $16.90 and a 12 month high of $17.30. The firm has a market cap of $425.10 million, a PE ratio of 15.68 and a beta of 1.16.

- [By Joseph Griffin]

Superior Coin (CURRENCY:SUP) traded up 28.5% against the US dollar during the one day period ending at 0:00 AM E.T. on June 14th. During the last seven days, Superior Coin has traded up 26.1% against the US dollar. Superior Coin has a market cap of $0.00 and $1,434.00 worth of Superior Coin was traded on exchanges in the last day. One Superior Coin coin can now be purchased for $0.0010 or 0.00000015 BTC on popular cryptocurrency exchanges including BTC-Alpha and SouthXchange.

Top 10 Medical Stocks To Watch For 2019: Buenaventura Mining Company Inc.(BVN)

Advisors' Opinion:- [By Logan Wallace]

ClariVest Asset Management LLC raised its position in shares of Compania de Minas Buenaventura SAA (NYSE:BVN) by 22.8% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 347,900 shares of the mining company’s stock after purchasing an additional 64,500 shares during the period. ClariVest Asset Management LLC owned approximately 0.14% of Compania de Minas Buenaventura SAA worth $4,742,000 at the end of the most recent reporting period.

- [By Shane Hupp]

Compania de Minas Buenaventura SAA (NYSE:BVN) was downgraded by equities research analysts at ValuEngine from a “buy” rating to a “hold” rating in a research note issued to investors on Monday.

- [By Shane Hupp]

Employees Retirement System of Texas bought a new position in shares of Compania de Minas Buenaventura SAA (NYSE:BVN) in the 2nd quarter, HoldingsChannel.com reports. The institutional investor bought 231,000 shares of the mining company’s stock, valued at approximately $3,149,000.

Top 10 Medical Stocks To Watch For 2019: Discovery Communications, Inc.(DISCB)

Advisors' Opinion:- [By Billy Duberstein]

Discovery, Inc. (NASDAQ:DISCA) (NASDAQ:DISCB) (NASDAQ:DISCK) has traded very cheaply over the past few years. As more and more U.S. consumers "cut the cord" on the traditional cable bundle, Discovery's channels (which now include all Scripps Networks Interactive channels) have seen their subscriber counts decline. That, combined with the high debt load incurred for the company's 2017 acquisition of Scripps Networks Interactive, sent investors running for the hills last year. In 2017, the company's three share classes dropped from roughly 10% to roughly 21%.

- [By Max Byerly]

Discovery (NASDAQ:DISCB) announced its quarterly earnings results on Tuesday. The company reported $0.53 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.40 by $0.13, Morningstar.com reports. Discovery had a negative net margin of 7.40% and a positive return on equity of 19.34%. The company had revenue of $2.31 billion for the quarter.

- [By Billy Duberstein]

You might think Discovery Inc.'s (NASDAQ:DISCA) (NASDAQ:DISCK) (NASDAQ:DISCB) stations primarily feature nature videos and celebrity cooks, but did you know it's actually becoming a player on the international sports scene? While known for its namesake Discovery Channel and documentary brands such as The Learning Channel, HGTV, and the Food Network, Discovery has actually been in the sports business since 2012, when it first acquired a minority stake in European sports channel Eurosport. Discovery was apparently pleased enough with the channel's progress to buy 100% of Eurosport in July 2015, and that year, Eurosport won the exclusive rights to broadcast the Olympics in Europe from 2018-2022.

Thursday, March 21, 2019

Norwegian Cruise Line CEO: Attracting millennial guests through Instagram

Millenials make up 25 percent of Norwegian Cruise Line's bookings and the company is putting more accommodations on board its ships to attract the fastest-growing customer base, CEO Frank Del Rio told CNBC Tuesday.

"We are now building ships with the understanding that Instagram is something to deal with," he said in an interview with "Mad Money's" Jim Cramer. "We're actually creating Instagram venues so that, when you get the urge, they're going to go there and that's the best publicity [we] can have."

Instagram is owned by social media giant Facebook.

Norwegian has ordered nearly a dozen new ships to be completed through 2027 and their completion dates are staggered as to not "choke on the inventory," Del Rio said. He noted that critics that are worried about a looming recession is looming thought it was not a good idea to add more ships because the industry is a "discretionary product," but the chief is optimistic about the future.

"First of all, there's no recession. We're past that, I hope. And the thing to understand, unlike the hotel industry, the airline industry, our ships run full and they run full all the time," he said. "So if you've got full ships all the time and you can finance the brand new ones at interest rates of less than 3 percent over 12-years fixed ... You'd order more ships."

The future for Norwegian Cruise is looking bright because customers are booking as far as eight months out, Del Rio said. He pointed out that 65 percent of 2019 inventory was sold at the the turn of the year and 35 percent of 2020 inventory in some brands has been booked. Cash flow is "off the charts" and is the most "misunderstood variable in this whole equation," he added.

Norwegian Cruise is also refocusing on Turkey where trips were cut due to geopolitical events in 2016, Del Rio said. The cruise line has a dozen sailings to the country and plans to increase its count to 20 next year, he said.

Itineraries that include Turkey have been selling fast and at higher prices, he said.

"So the good news is that Americans are willing to go back to Turkey," Del Rio said.

WATCH: Cramer chats with Norwegian CEO Del Rio about the company's performance show chapters Norwegian Cruise Line CEO: Attracting millennial guests through Instagram 1 Hour Ago | 07:58

Norwegian Cruise Line CEO: Attracting millennial guests through Instagram 1 Hour Ago | 07:58 Disclosure: Cramer's charity trust owns shares of Facebook.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com

Tuesday, March 19, 2019

United Continental Holdings Inc (UAL) Short Interest Update

United Continental Holdings Inc (NASDAQ:UAL) saw a significant increase in short interest in February. As of February 28th, there was short interest totalling 21,022,387 shares, an increase of 11.3% from the February 15th total of 18,887,278 shares. Approximately 7.7% of the company’s stock are sold short. Based on an average daily trading volume, of 2,591,384 shares, the short-interest ratio is currently 8.1 days.

United Continental Holdings Inc (NASDAQ:UAL) saw a significant increase in short interest in February. As of February 28th, there was short interest totalling 21,022,387 shares, an increase of 11.3% from the February 15th total of 18,887,278 shares. Approximately 7.7% of the company’s stock are sold short. Based on an average daily trading volume, of 2,591,384 shares, the short-interest ratio is currently 8.1 days.

NASDAQ UAL opened at $81.49 on Friday. The company has a debt-to-equity ratio of 1.34, a quick ratio of 0.47 and a current ratio of 0.54. United Continental has a 52-week low of $64.79 and a 52-week high of $97.85. The stock has a market cap of $21.30 billion, a P/E ratio of 8.93, a P/E/G ratio of 0.35 and a beta of 0.98.

Get United Continental alerts:United Continental (NASDAQ:UAL) last released its quarterly earnings results on Tuesday, January 15th. The transportation company reported $2.41 earnings per share (EPS) for the quarter, topping the Zacks’ consensus estimate of $1.84 by $0.57. United Continental had a return on equity of 27.73% and a net margin of 5.15%. The firm had revenue of $10.49 billion for the quarter, compared to analyst estimates of $10.34 billion. During the same quarter last year, the company posted $1.40 earnings per share. The business’s revenue was up 11.0% on a year-over-year basis. Analysts predict that United Continental will post 11.41 earnings per share for the current fiscal year.

Several equities analysts have issued reports on UAL shares. Cowen reaffirmed a “market perform” rating and set a $99.00 price objective (up previously from $94.00) on shares of United Continental in a report on Thursday, January 17th. Vertical Research started coverage on United Continental in a report on Monday, February 4th. They set a “buy” rating and a $103.00 price objective on the stock. Zacks Investment Research lowered United Continental from a “buy” rating to a “hold” rating in a report on Tuesday, December 18th. JPMorgan Chase & Co. raised United Continental from a “neutral” rating to an “overweight” rating and set a $95.00 price objective on the stock in a report on Thursday, January 10th. Finally, Credit Suisse Group started coverage on United Continental in a report on Monday, November 19th. They set an “outperform” rating and a $113.00 price objective on the stock. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and twelve have given a buy rating to the company’s stock. United Continental has a consensus rating of “Buy” and a consensus target price of $100.88.

Several hedge funds and other institutional investors have recently added to or reduced their stakes in UAL. MML Investors Services LLC grew its holdings in shares of United Continental by 8.1% during the fourth quarter. MML Investors Services LLC now owns 4,486 shares of the transportation company’s stock worth $376,000 after buying an additional 336 shares during the last quarter. Kentucky Retirement Systems Insurance Trust Fund purchased a new position in shares of United Continental during the fourth quarter worth about $379,000. Municipal Employees Retirement System of Michigan purchased a new position in shares of United Continental during the fourth quarter worth about $515,000. Kentucky Retirement Systems purchased a new position in shares of United Continental during the fourth quarter worth about $834,000. Finally, HighPoint Advisor Group LLC purchased a new position in shares of United Continental during the fourth quarter worth about $879,000. 97.71% of the stock is currently owned by hedge funds and other institutional investors.

TRADEMARK VIOLATION NOTICE: This news story was first published by Ticker Report and is the property of of Ticker Report. If you are viewing this news story on another publication, it was illegally stolen and republished in violation of U.S. & international copyright law. The legal version of this news story can be read at https://www.tickerreport.com/banking-finance/4222003/united-continental-holdings-inc-ual-short-interest-update.html.

About United Continental

United Continental Holdings, Inc, together with its subsidiaries, provides air transportation services in North America, the Asia-Pacific, Europe, the Middle East, Africa, and Latin America. It transports people and cargo through its mainline and regional operations. As of December 31, 2017, the company operated a fleet of 1,262 aircraft.

Further Reading: How Buying a Call Option Works

Sunday, March 17, 2019

Trump Outlines a Significant Social Security Cut in His 2020 Budget

This past Monday, March 11, President Trump unveiled his fiscal 2020 budget proposal for the federal government. As a reminder, fiscal years for the federal government end on Sept. 30 and begin on Oct. 1. Unveiling a budget months in advance of the actual implementation is supposed to allow Congress to make tweaks, as needed, to get a yearlong budget passed.

Trump's 2020 budget featured a lot of talking points (as presidential budgets often do), a number of which came under harsh criticism by members of the Democratic Party.

President Trump giving remarks at the Pentagon. Image source: Official White House Photo by Tia Dufour.

In particular, political opponents of the president focused on a handful of proposed cuts to social programs, which go against Trump's campaign promises in 2016 not to touch so-called entitlement programs like Medicare and Social Security.

Contained within the president's budget were calls for about $1.5 trillion in cuts to Medicaid over the next 10 years, which would be achieved by moving payouts to block grants; an $845 billion reduction to Medicare spending over the next decade that targets a decrease in wasteful spending via lower prescription drug costs; and -- surprise -- a roughly $26 billion decrease in Social Security spending over the next 10 years.

Trump's budget calls for a big change to Social Security's disability programWhile Trump's budget proposal aims to curtail a number of perceived inefficiencies with the Social Security program, the bulk of the savings ($10 billion total between 2020 and 2029) are expected to be realized from a single change to the Social Security Disability Insurance program.

As of January 2019, according to the Social Security Administration (SSA), 10.15 million people were receiving a Disability Insurance benefit payment each month, 8.52 million of whom were long-term disabled workers. Of course, proving a long-term disability to the SSA, assuming you have the required lifetime work credits to receive a disability benefit, isn't a flip-of-the-switch process. Rather, the average time from application to approval can take around five months.

Image source: Getty Images.

However, not all disability recipients file their claims with the SSA right away. Should you choose to apply for Social Security Disability Insurance long after you've actually become disabled, you may be able to receive retroactive benefits. These retroactive disability benefits would cover the time period from when you actually became disabled through when you applied for Social Security Disability benefits, with a maximum collectible period of 12 months.

It should be noted that the SSA will subtract the five-month waiting period from your filing, meaning you must apply for benefits 17 months or longer after the onset of your disability if you're to receive the full 12 months of retroactive disability pay.

Trump's budget proposal for fiscal 2020 aims to halve the amount of retroactive pay disabled persons can recover to six months from 12 months. Doing so would reduce program outlays by $3.61 billion between 2020 and 2024, and almost $10 billion on the dot, in aggregate, over the next decade.

Relax, folks, this Social Security cut has virtually no chance of being implementedWith Trump proposing $26 billion in cuts to Social Security between 2020 and 2029, you might be growing a bit concerned that bigger expenditure cuts might follow. But this is the point where I tell you that everything's going to be OK. In fact, the chance of this particular proposal being implemented is very slim, in my opinion.

To begin with, presidential budgets are often a rough draft from which Congress begins pushing and pulling to fit certain fiscal and political agendas. Or, in plain English, it's a starting point from which discussion begins, not a final draft. By the time a federal spending bill has been signed into law, it often looks nothing like the annual budget or 10-year projections presented months earlier by the president.

Image source: Getty Images.

Secondly, a divided Congress practically ensures that next to nothing is going to get done when it comes to major social programs like Medicare, Medicaid, and Social Security. Democrats in the House are certain to oppose any reduction to Social Security benefits, including halving the period whereby retroactive disability benefits can be collected. Without support from the Democratic majority in the House, I don't see how this provision has any chance of being included in a final spending bill for fiscal 2020.

Third and finally, Trump is unlikely to take a hard-line stance on keeping this provision in his budget, especially with his own election now less than 20 months away. Back in 2013, while speaking at the Conservative Political Action Conference, Trump had this to say:

As Republicans, if you think you are going to change very substantially for the worse Medicare, Medicaid, and Social Security in any substantial way, and at the same time you think you are going to win elections, it just really is not going to happen... What we have to do and the way to solve our problems is to build a great economy.

In other words, Trump understands that direct changes to Social Security means some group is going to lose out and be worse off than they were before. Therefore, making any direct changes to Social Security prior to an election is akin to political suicide.

Long story short, President Trump's budget is bound to hit on a number of talking points, but it's unlikely to incite any change to the existing structure of the Social Security program.

Saturday, March 16, 2019

Aurora Cannabis shares surge after hiring billionaire activist investor Nelson Peltz as an advisor

Aurora Cannabis announced Wednesday that it has appointed longtime activist investor Nelson Peltz as a strategic advisor to the company.

Peltz will "work collaboratively and strategically to explore potential partnerships that would be the optimal strategic fit for successful entry into each of Aurora's contemplated market segment," Aurora said in a press release.

Aurora shares surged 8 percent in premarket trading following the release. The company added that it has granted Peltz options to purchase 19.96 million common Aurora shares at a price of CA$10.34.

"I believe Aurora has a solid execution track record, is strongly differentiated from its peers, has achieved integration throughout the value chain and is poised to go to the next level across a range of industry verticals," Peltz said in the release.

"I also believe that Canadian licensed producers, and Aurora in particular, are well positioned to lead in the development of the international cannabis industry as regulations evolve, with a strong, globally replicable operating model," Peltz added.

The addition of Peltz to the Aurora team represents one of the largest endorsements of the nascent cannabis industry.

Peltz, who founded and serves at CEO of New York-based Trian Partners, has over the decades commanded respect across Wall Street for his investing prowess and ability to reshape companies. As an activist investor, Peltz and Trian Partners take stakes in public companies they believe are undervalued and push management to make changes over several years.

But Peltz will also prove a valuable addition to Aurora for his deep knowledge of the consumer goods industry, where he's tended to focus his investments over the years. Current investments for the multibillion-dollar fund include a $3.6 billion stake in Procter & Gamble, an $884 million stake in packaged foods giant Mondelez and a longtime, $471 million investment in Wendy's.

Trian also held shares in PepsiCo until 2016, when the activist investor ultimately dissolved its $2 billion stake after three years of deliberations with management.

Founded in 2006 by CEO Terry Booth and headquartered in Edmonton, Alberta, Aurora is one of the largest cannabis producers in the world and one of just a handful of Canadian licensed producers to date. Second in market capitalization only to Ontario-based Canopy Growth, Aurora has grown both revenues and earnings at a dizzying pace in recent years as more jurisdictions approve the adult use of recreational marijuana.

Last month, the company said it grew net sales by 363 percent on a year-over-year basis and added that it increased kilograms sold in its second fiscal quarter to 6,999, up 162 percent from a year ago. But for Aurora and its peers, the addition of a renowned investor — or a celebrity like Martha Stewart — will help continue to normalize an industry long pursued by global law enforcement.

"Nelson also takes a long-term view of value creation to benefit all stakeholders," Booth said Wednesday. "We look forward to working with Nelson to further extend our global cannabis industry leadership by aligning Aurora with each of the major market segments cannabis is set to impact."

Aurora shares are up more than 60 percent in 2019 and up nearly 10 percent in the past month, buoyed after leading cannabis analyst Vivien Azer initiated coverage on the stock with the equivalent of a buy rating.

"Aurora is well positioned to benefit in the early innings of the Canadian adult use market, given its impressive 20 percent market share," the Cowen analyst wrote earlier this month. "The company's large cultivation footprint, capable of producing over 575,000 kilograms, provides Aurora with the necessary infrastructure to weather early storms in adult use."

Canada became the first Group of Seven country to OK recreational use of pot on Oct. 17. Marijuana remains illegal on a federal level in the United States, but 10 states and the District of Columbia have allowed its use for recreational purposes.

Aurora stock trades under the ticker ACB on both the New York Stock Exchange and the Toronto Stock Exchange.

Wednesday, March 13, 2019

Boston Scientific Co. (BSX) SVP Wendy Carruthers Sells 29,412 Shares

Boston Scientific Co. (NYSE:BSX) SVP Wendy Carruthers sold 29,412 shares of the firm’s stock in a transaction that occurred on Monday, March 11th. The stock was sold at an average price of $39.63, for a total transaction of $1,165,597.56. Following the sale, the senior vice president now directly owns 200,751 shares in the company, valued at approximately $7,955,762.13. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link.

Boston Scientific Co. (NYSE:BSX) SVP Wendy Carruthers sold 29,412 shares of the firm’s stock in a transaction that occurred on Monday, March 11th. The stock was sold at an average price of $39.63, for a total transaction of $1,165,597.56. Following the sale, the senior vice president now directly owns 200,751 shares in the company, valued at approximately $7,955,762.13. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link.

NYSE:BSX opened at $40.26 on Wednesday. Boston Scientific Co. has a 1-year low of $26.27 and a 1-year high of $41.00. The company has a debt-to-equity ratio of 0.55, a quick ratio of 0.56 and a current ratio of 0.76. The firm has a market capitalization of $54.76 billion, a P/E ratio of 27.39, a PEG ratio of 2.30 and a beta of 0.83.

Get Boston Scientific alerts:Boston Scientific (NYSE:BSX) last posted its quarterly earnings data on Wednesday, February 6th. The medical equipment provider reported $0.39 earnings per share for the quarter, beating analysts’ consensus estimates of $0.37 by $0.02. The firm had revenue of $2.56 billion for the quarter, compared to analyst estimates of $2.57 billion. Boston Scientific had a net margin of 17.01% and a return on equity of 25.92%. Boston Scientific’s quarterly revenue was up 6.4% on a year-over-year basis. During the same period last year, the firm posted $0.34 EPS. Analysts forecast that Boston Scientific Co. will post 1.56 earnings per share for the current fiscal year.

A number of analysts have weighed in on the stock. Argus raised their price objective on shares of Boston Scientific from $43.00 to $45.00 and gave the stock a “buy” rating in a report on Wednesday, February 13th. Canaccord Genuity reaffirmed a “buy” rating and issued a $45.00 target price on shares of Boston Scientific in a report on Monday, February 11th. SunTrust Banks reaffirmed a “buy” rating and issued a $47.00 target price on shares of Boston Scientific in a report on Friday, February 8th. Guggenheim reaffirmed a “buy” rating and issued a $48.00 target price on shares of Boston Scientific in a report on Friday, February 8th. Finally, Needham & Company LLC reaffirmed a “buy” rating and issued a $43.00 target price on shares of Boston Scientific in a report on Wednesday, February 6th. Three investment analysts have rated the stock with a hold rating, twenty-two have assigned a buy rating and two have assigned a strong buy rating to the stock. The stock presently has a consensus rating of “Buy” and an average target price of $40.54.

Several hedge funds and other institutional investors have recently modified their holdings of the business. American Century Companies Inc. boosted its position in shares of Boston Scientific by 0.8% during the 4th quarter. American Century Companies Inc. now owns 4,136,750 shares of the medical equipment provider’s stock worth $146,193,000 after purchasing an additional 34,818 shares in the last quarter. Norges Bank purchased a new stake in shares of Boston Scientific during the 4th quarter worth $468,943,000. Actinver Wealth Management Inc. purchased a new stake in shares of Boston Scientific during the 4th quarter worth $250,000. Kentucky Retirement Systems Insurance Trust Fund purchased a new stake in shares of Boston Scientific during the 4th quarter worth $967,000. Finally, B.S. Pension Fund Trustee Ltd acting for the British Steel Pension Fund purchased a new stake in shares of Boston Scientific during the 4th quarter worth $598,000. Institutional investors own 91.34% of the company’s stock.

COPYRIGHT VIOLATION WARNING: “Boston Scientific Co. (BSX) SVP Wendy Carruthers Sells 29,412 Shares” was published by Ticker Report and is the sole property of of Ticker Report. If you are viewing this story on another domain, it was copied illegally and republished in violation of United States and international copyright laws. The legal version of this story can be viewed at https://www.tickerreport.com/banking-finance/4217530/boston-scientific-co-bsx-svp-wendy-carruthers-sells-29412-shares.html.About Boston Scientific

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through three segments: MedSurg, Rhythm and Neuro, and Cardiovascular. The company offers interventional cardiology products, including drug-eluting coronary stent systems used in the treatment of coronary artery disease; percutaneous coronary interventions therapy products to treat atherosclerosis; intravascular catheter-directed ultrasound imaging catheters, fractional flow reserve devices, and systems for use in coronary arteries and heart chambers, as well as certain peripheral vessels; and structural heart therapy systems.

Featured Article: Gap Up Stocks

Why Shares of ADT Plunged Tuesday Morning

Shares of ADT (NYSE:ADT) fell by more than 12% Tuesday morning after the home security systems provider reported a fourth-quarter loss and predicted 2019 earnings would come in below expectations.

So whatADT reported fourth-quarter revenue of $1.19 billion, up 7% year over year and ahead of the $1.16 billion consensus estimate, but the company's adjusted loss of $0.04 per share was significantly below the expected profit of $0.12 per share. The company also said it expects full-year 2019 EBITDA of between $2.46 billion and $2.5 billion, short of the $2.56 billion expectation.

Image source: Getty Images.

The company also said it expects free cash flow to grow by 6% to 13% this year, well below the 33% growth it reported in 2018, as ADT ramps up spending on hiring and marketing. CFO Jeffrey Likosar on a call with investors said, "[W]e will make selective brand investments as we continue to solidify ADT's position as the leader in home automation and in security."

With the drop, ADT is now down 46% since its January 2018 initial public offering.

Now whatADT's bread-and-butter home monitoring system has come under pressure from a new generation of self-installed security products, including Alphabet's Nest, available at a lower monthly fee.

The company has a competing product, called Pulse, and is working on a partnership with Amazon.com. It also has acquired do-it-yourself home security provider Lifeshield for $25 million to bolster its offering. But these investments will take time to pan out, and investors on Tuesday were in no mood to hold tight and wait for that improvement.

Tuesday, March 12, 2019

7 Hello Spring Images to Welcome the New Season

The sunshine is returning in only a matter of days and we have compiled seven hello spring images to welcome back the new season.

Source: Jocelyn Kinghorn via Flickr

Source: Jocelyn Kinghorn via Flickr

It’s been a cold winter marked by plenty of snowfall, little sunshine and unpredictable weather throughout most of the season across the northern part of the U.S., and even some areas in the south. Thankfully, the snow is starting to recede, the ice floes are melting and winter is moving away to make way for the beginning of spring.

Over the next few slides, we have chosen the spring images that most resonate with us for you to peruse. Pick your favorite and share it on social media with your friends and family.

We hope you have a great spring and a productive rest of your 2019.

Compare Brokers

Hello Spring

Source: Pexel

Source: Pexel

Compare Brokers

Hello Spring

Source: Pixabay

Source: Pixabay

Compare Brokers

Hello Spring

Source: Flickr

Source: Flickr

Compare Brokers

Hello Spring

Source: DeviantART

Source: DeviantART

Compare Brokers

Hello Spring

Source: Pixabay

Source: Pixabay

Compare Brokers

Hello Spring

Source: Geograph

Source: GeographSONY DSC

Compare Brokers

Hello Spring

Source: Geograph

Source: Geograph

Sunday, March 10, 2019

Zacks: Analysts Anticipate United Parcel Service, Inc. (UPS) Will Announce Earnings of $1.48 Per Sha

Equities research analysts expect United Parcel Service, Inc. (NYSE:UPS) to post $1.48 earnings per share (EPS) for the current quarter, Zacks Investment Research reports. Seven analysts have issued estimates for United Parcel Service’s earnings, with the lowest EPS estimate coming in at $1.41 and the highest estimate coming in at $1.70. United Parcel Service reported earnings per share of $1.55 during the same quarter last year, which would suggest a negative year over year growth rate of 4.5%. The business is scheduled to announce its next earnings report on Thursday, April 25th.

Equities research analysts expect United Parcel Service, Inc. (NYSE:UPS) to post $1.48 earnings per share (EPS) for the current quarter, Zacks Investment Research reports. Seven analysts have issued estimates for United Parcel Service’s earnings, with the lowest EPS estimate coming in at $1.41 and the highest estimate coming in at $1.70. United Parcel Service reported earnings per share of $1.55 during the same quarter last year, which would suggest a negative year over year growth rate of 4.5%. The business is scheduled to announce its next earnings report on Thursday, April 25th.

According to Zacks, analysts expect that United Parcel Service will report full year earnings of $7.58 per share for the current year, with EPS estimates ranging from $7.50 to $7.71. For the next year, analysts anticipate that the company will report earnings of $8.16 per share, with EPS estimates ranging from $7.35 to $8.40. Zacks Investment Research’s EPS calculations are a mean average based on a survey of sell-side analysts that follow United Parcel Service.

Get United Parcel Service alerts:United Parcel Service (NYSE:UPS) last posted its quarterly earnings data on Thursday, January 31st. The transportation company reported $1.94 EPS for the quarter, beating analysts’ consensus estimates of $1.91 by $0.03. The business had revenue of $19.85 billion for the quarter, compared to analyst estimates of $19.92 billion. United Parcel Service had a return on equity of 254.74% and a net margin of 6.67%. During the same quarter last year, the company earned $1.67 earnings per share.

A number of analysts recently commented on the company. Morgan Stanley decreased their price objective on United Parcel Service from $92.00 to $87.00 and set a “sell” rating on the stock in a research note on Tuesday, December 4th. Standpoint Research lowered United Parcel Service from a “buy” rating to a “hold” rating in a research note on Thursday, February 7th. Credit Suisse Group reaffirmed a “neutral” rating and set a $114.00 price objective on shares of United Parcel Service in a research note on Wednesday. Zacks Investment Research lowered United Parcel Service from a “hold” rating to a “sell” rating in a research note on Saturday, January 26th. Finally, Bank of America reaffirmed a “neutral” rating and set a $112.00 price objective (down previously from $116.00) on shares of United Parcel Service in a research note on Friday, February 1st. Two research analysts have rated the stock with a sell rating, twelve have issued a hold rating, four have issued a buy rating and one has issued a strong buy rating to the stock. United Parcel Service has an average rating of “Hold” and an average price target of $123.41.

Shares of UPS traded down $1.99 during trading hours on Thursday, reaching $106.86. 3,979,700 shares of the company traded hands, compared to its average volume of 3,231,828. The company has a quick ratio of 1.14, a current ratio of 1.12 and a debt-to-equity ratio of 6.56. The firm has a market cap of $94.82 billion, a P/E ratio of 14.76, a PEG ratio of 1.66 and a beta of 1.18. United Parcel Service has a fifty-two week low of $89.89 and a fifty-two week high of $125.09.

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, March 12th. Shareholders of record on Tuesday, February 26th will be paid a $0.96 dividend. This represents a $3.84 dividend on an annualized basis and a yield of 3.59%. This is a positive change from United Parcel Service’s previous quarterly dividend of $0.91. The ex-dividend date of this dividend is Monday, February 25th. United Parcel Service’s dividend payout ratio (DPR) is presently 50.28%.

In other United Parcel Service news, SVP Teri P. Mcclure sold 5,000 shares of the firm’s stock in a transaction dated Monday, February 25th. The stock was sold at an average price of $109.72, for a total value of $548,600.00. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CFO Richard N. Peretz sold 9,112 shares of the firm’s stock in a transaction dated Wednesday, February 13th. The stock was sold at an average price of $111.18, for a total value of $1,013,072.16. The disclosure for this sale can be found here. 0.56% of the stock is currently owned by company insiders.

Large investors have recently modified their holdings of the business. Investors Asset Management of Georgia Inc. GA ADV raised its holdings in shares of United Parcel Service by 2.2% in the 4th quarter. Investors Asset Management of Georgia Inc. GA ADV now owns 4,585 shares of the transportation company’s stock worth $447,000 after purchasing an additional 100 shares during the period. DeDora Capital Inc. raised its holdings in shares of United Parcel Service by 4.9% in the 4th quarter. DeDora Capital Inc. now owns 2,184 shares of the transportation company’s stock worth $213,000 after purchasing an additional 103 shares during the period. Gemmer Asset Management LLC raised its holdings in shares of United Parcel Service by 30.3% in the 4th quarter. Gemmer Asset Management LLC now owns 499 shares of the transportation company’s stock worth $49,000 after purchasing an additional 116 shares during the period. ZWJ Investment Counsel Inc. raised its holdings in shares of United Parcel Service by 1.9% in the 4th quarter. ZWJ Investment Counsel Inc. now owns 6,573 shares of the transportation company’s stock worth $641,000 after purchasing an additional 122 shares during the period. Finally, Buffington Mohr McNeal raised its holdings in shares of United Parcel Service by 3.0% in the 4th quarter. Buffington Mohr McNeal now owns 4,567 shares of the transportation company’s stock worth $445,000 after purchasing an additional 131 shares during the period. 54.46% of the stock is currently owned by hedge funds and other institutional investors.

About United Parcel Service

United Parcel Service, Inc provides letter and package delivery, specialized transportation, logistics, and financial services. It operates through three segments: U.S. Domestic Package, International Package, and Supply Chain & Freight. The U.S. Domestic Package segment offers time-definite delivery of letters, documents, small packages, and palletized freight through air and ground services in the United States.

Featured Article: Why do companies pay special dividends?

Get a free copy of the Zacks research report on United Parcel Service (UPS)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

Friday, March 8, 2019

Takeaways From Target's Top-Notch Q4 Report

Investors should be quite happy with the holiday-quarter results that Target (NYSE:TGT) delivered Tuesday. It beat expectations on revenue and profits, and comp sales and digital sales growth were phenomenal. How does Target keep performing at this pace?

In this segment from MarketFoolery, host Chris Hill and analyst Abi Malin talk about the retailer's e-commerce strength, its operational chops, CEO Brian Cornell's tenure, the stock's performance, and more.

A full transcript follows the video.

This video was recorded on March 5, 2019.

Chris Hill: We're going to start with Target. Fantastic holiday quarter. Profits and revenue came in higher than expected. Their digital sales continue to climb. Stock up nicely today.

Abi Malin: The stock is up nicely. As you mentioned, this is their fifth consecutive year of digital sales growing at a greater than 25% clip, which is actually phenomenal for them. But overall, Target has continued to thrive even in the space of flagging retail, and I think part of that is tempered expectations from analysts. I don't think anyone was expecting that Q4 comp sales were 5.3%, including in-store sales up 2.9% and digital sales up 31%. Those numbers are just phenomenal, especially given the landscape of retail.

Hill: Yeah. The thing that stood out to me was that, that same-store sales number coming in higher than 5%. For a retailer of this size, I thought it was great. I was a little surprised when I went back over the last couple of years, looking through the various places that this stock has visited. I think of Brian Cornell, the CEO at Target, as being a fantastic leader of this business. I think this August is going to be the five-year anniversary of Cornell taking over as CEO. He came in at a tough time for Target. Had a great first year. Again, the stock has bounced around to different places. But I think operationally, Target is definitely in the upper echelon of the traditional bricks-and-mortar retailers, especially when you consider its size, and, to your point, especially when you consider what they've been doing with digital sales.

Malin: Yeah, they have a footprint of 1,800 stores. That's no small feat to manage. Increasingly in this space, you've seen, there's the really good operators -- Target, Walmart, Costco, -- and then you have your worse-off ones, and there's really no middle space. Again, I think you know the stock's reacting positively because even for the best of the best, this was a pretty phenomenal end of the year for them.

Hill: In terms of kicking off this new fiscal year, they seemed pretty optimistic. The guidance seemed pretty good. It seems like if, you're looking for the stock to move higher in a meaningful way over the next 12 months, they have to follow up this strong holiday quarter with at least a couple more -- maybe not coming in close to 5.5% comps, but they really can't do much worse than that.

Malin: Yeah. I think it's all relative, too, to overall market performance. We've been talking for -- it feels like forever -- maybe two years about how the markets seem highly valued and pretty frothy. You've seen the tech space heat up, and recently it's cooled off a little bit, so that's a little less volatility. But I think in the event that we do start to see less growth orientation in the market, Target could be actually well-positioned from an overall portfolio management strategy.

Tuesday, March 5, 2019

Why Zogenix Shares Soared 20.5% in February

After Zogenix (NASDAQ:ZGNX) announced it has submitted marketing applications in the U.S. and Europe for approval for Fintepla (formerly ZX008) for treatment of Dravet syndrome, shares gained 20.5% in February, according to S&P Global Market Intelligence.

So whatA low-dose formulation of fenfluramine, Fintepla has demonstrated a remarkable ability to reduce seizures in Dravet syndrome patients.

IMAGE SOURCE: GETTY IMAGES.

Dravet syndrome is historically tough to treat, and there's only one FDA-approved medication specifically targeting it: GW Pharmaceuticals' (NASDAQ:GWPH) Epidiolex.

In trials, Fintepla produced a 62.7% decline in monthly seizures, significantly outperforming the 1.2% decline witnessed in the placebo group.

There aren't any head-to-head studies comparing Epidiolex to Fintepla, but Fintepla appears to be more effective than Epidiolex. In two phase 3 studies, Epidiolex reduced convulsive seizures by between 39% and 49%, respectively.

Now whatThe FDA hasn't announced its acceptance of Fintepla's filing yet, but the EU application was accepted, setting the stage there for a decision early in 2020. If all the i's were dotted and t's crossed in the FDA application, then Fintepla could be on the market next year in both of these big markets.

There's no guarantee of approval, though. Regulators will undoubtedly review safety data carefully, because fenfluramine was the "fen" part of an obesity drug known as fen-phen that was pulled from the market in the 1990s for increasing cardiovascular risks. Fintepla's safety in these trials looks pretty solid, though.

Zogenix is also studying Fintepla in Lennox-Gastaut syndrome (LGS), another rare form of epilepsy that's inadequately controlled by existing therapies. Data that could support approval in LGS is expected in Q1, 2020. If the data is good, then Fintepla could be competing against Epidiolex in both Dravet syndrome and Lennox-Gastaut syndrome by 2021.

Sunday, March 3, 2019

IoT Chain Price Reaches $0.11 (ITC)

IoT Chain (CURRENCY:ITC) traded 1% lower against the US dollar during the 24 hour period ending at 8:00 AM E.T. on March 2nd. In the last seven days, IoT Chain has traded down 7.7% against the US dollar. One IoT Chain token can currently be bought for about $0.11 or 0.00002807 BTC on exchanges including OKEx, Bithumb, Bibox and Kucoin. IoT Chain has a total market cap of $7.68 million and approximately $387,446.00 worth of IoT Chain was traded on exchanges in the last day.

IoT Chain (CURRENCY:ITC) traded 1% lower against the US dollar during the 24 hour period ending at 8:00 AM E.T. on March 2nd. In the last seven days, IoT Chain has traded down 7.7% against the US dollar. One IoT Chain token can currently be bought for about $0.11 or 0.00002807 BTC on exchanges including OKEx, Bithumb, Bibox and Kucoin. IoT Chain has a total market cap of $7.68 million and approximately $387,446.00 worth of IoT Chain was traded on exchanges in the last day.

Here is how related cryptocurrencies have performed in the last day:

Get IoT Chain alerts: XRP (XRP) traded down 1% against the dollar and now trades at $0.32 or 0.00008181 BTC. Tether (USDT) traded up 0.1% against the dollar and now trades at $1.01 or 0.00026134 BTC. Stellar (XLM) traded down 0.4% against the dollar and now trades at $0.0848 or 0.00002193 BTC. Binance Coin (BNB) traded up 2.4% against the dollar and now trades at $11.30 or 0.00292309 BTC. TRON (TRX) traded down 3.8% against the dollar and now trades at $0.0229 or 0.00000591 BTC. Bitcoin SV (BSV) traded down 1.3% against the dollar and now trades at $67.17 or 0.01737765 BTC. IOTA (MIOTA) traded 1.6% lower against the dollar and now trades at $0.29 or 0.00007574 BTC. Maker (MKR) traded 0.6% higher against the dollar and now trades at $680.12 or 0.17595789 BTC. NEO (NEO) traded down 0.3% against the dollar and now trades at $8.90 or 0.00230148 BTC. IOStoken (IOST) traded 0.3% lower against the dollar and now trades at $0.0396 or 0.00000526 BTC.IoT Chain Profile

IoT Chain (ITC) is a token. It was first traded on December 19th, 2017. IoT Chain’s total supply is 100,000,000 tokens and its circulating supply is 70,723,811 tokens. IoT Chain’s official Twitter account is @IoT_Chain. The Reddit community for IoT Chain is /r/itcofficial and the currency’s Github account can be viewed here. The official website for IoT Chain is iotchain.io.

IoT Chain Token Trading

IoT Chain can be traded on these cryptocurrency exchanges: Bithumb, Huobi, OKEx, Kucoin and Bibox. It is usually not currently possible to purchase alternative cryptocurrencies such as IoT Chain directly using US dollars. Investors seeking to trade IoT Chain should first purchase Bitcoin or Ethereum using an exchange that deals in US dollars such as Coinbase, GDAX or Gemini. Investors can then use their newly-acquired Bitcoin or Ethereum to purchase IoT Chain using one of the exchanges listed above.

new TradingView.widget({ “height”: 400, “width”: 650, “symbol”: “ITCUSD”, “interval”: “D”, “timezone”: “Etc/UTC”, “theme”: “White”, “style”: “1”, “locale”: “en”, “toolbar_bg”: “#f1f3f6”, “enable_publishing”: false, “hideideas”: true, “referral_id”: “2588”});

Saturday, March 2, 2019

Disney+ Will Take Exclusivity and Originals to the Next Level

We've been promised "Netflix killers" for nearly as long as Netflix (NASDAQ:NFLX) has been in the streaming business. But the pretenders have not been able to take the throne, so skepticism toward the latest wave -- which includes offerings from Disney (NYSE:DIS), Apple, and AT&T -- is understandable.

But one of these services is different from the rest. While Apple is pledging big bucks for original content and following the trail blazed by Netflix and others, Disney is coming from a different direction. Disney+ will be a new streaming service, but Disney's original content reputation precedes it by nearly a century.

Image source: Getty Images.

Netflix's brilliant original content strategyBy now, most observers of the streaming space are very familiar with Netflix's original content strategy. The idea is that Netflix absorbs the higher up-front cost of producing its own shows and movies with an eye to saving money down the line by avoiding the endless payments and renegotiations that streaming licensing deals entail. With more competitors entering the streaming space, bidding wars over exclusive deals can easily get out of hand. While Netflix still ponies up for marquee licensed content (including Disney's own Star Wars movies and Marvel Studios films), such deals get a little less essential every time Netflix scores a big original hit.

It's no wonder, then, that other streaming services have followed Netflix's lead. Hulu, Amazon Prime Video, and other streaming services have worked to create original content in order to differentiate themselves and bring content costs down. But Netflix has the head start and nobody has come close to catching its subscriber count -- 139 million at least count.

Disney's inverted path to content/streaming integrationWe have seen a lot of streaming services become content producers. But now we're about to see something that hasn't happened before, at least not on this scale: a massive content producer becoming a streaming company.

And just as it's more efficient for a streaming service to own its own content than to cut deals with content companies, it's more efficient for major content producers to own their own streaming distributors. When Disney content airs on Disney's streaming service, all the money goes to Disney.

Netflix has created a real fan base for itself with originals like Stranger Things, but no Netflix original's fan base dates back further than 2013 -- the year that Netflix's first original series, House of Cards, premiered. By contrast, Disney owns many iconic properties that other streaming services have always had to rely on licensing deals to get.

A new level of exclusive contentA few caveats are important here. For one thing, some of Disney's biggest hits -- including some Star Wars films -- are tied up in TV deals that will keep them from defecting to Disney's own platform immediately, even as Disney pulls out of deals with Netflix. And it's not as though this is pure upside for Disney. While yanking Star Wars movies from Netflix and bringing them home will be a huge boost for Disney+, Disney will no longer be getting giant checks for licensing out its most popular movies.

It's clear that Netflix has never seen competition with this level of firepower in the original and exclusive content department. Amazon's top originals, for instance, are things like The Marvelous Mrs. Maisel, popular and critically acclaimed stuff, to be sure, but not exactly Star Wars or Marvel. Disney is showing up with stars like Mickey Mouse -- who first appeared in 1928 -- and that is going to make for a much more interesting competition.

And it's not just about what Disney has already made. Disney can come up with new shows and movies using its existing stable of franchises, and that's just what it's doing. Take The Mandalorian, for instance, a series that takes place in the Star Wars universe and which will air exclusively on Disney+.

A Netflix killer? MaybeNetflix got a very big head start in the streaming business. So it's no surprise that its competitors have failed to close the gap. But Disney is bringing some of the biggest franchises on the planet to the table. Disney does not have to convince consumers to try a new show in order to get them hooked, because it can rely on existing loyalty to everything from Pixar films to Star Wars. That gives Disney's original content and exclusivity strategy a distinctly different flavor from anything we -- or Netflix -- have seen before. If any company can take on Netflix for the top streaming spot, it's Disney.

Friday, March 1, 2019

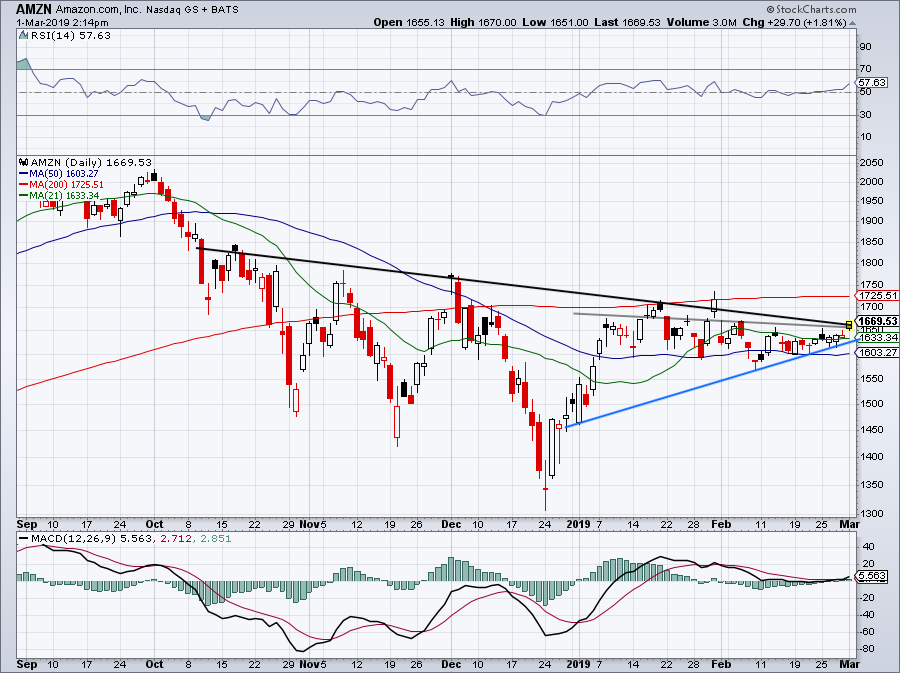

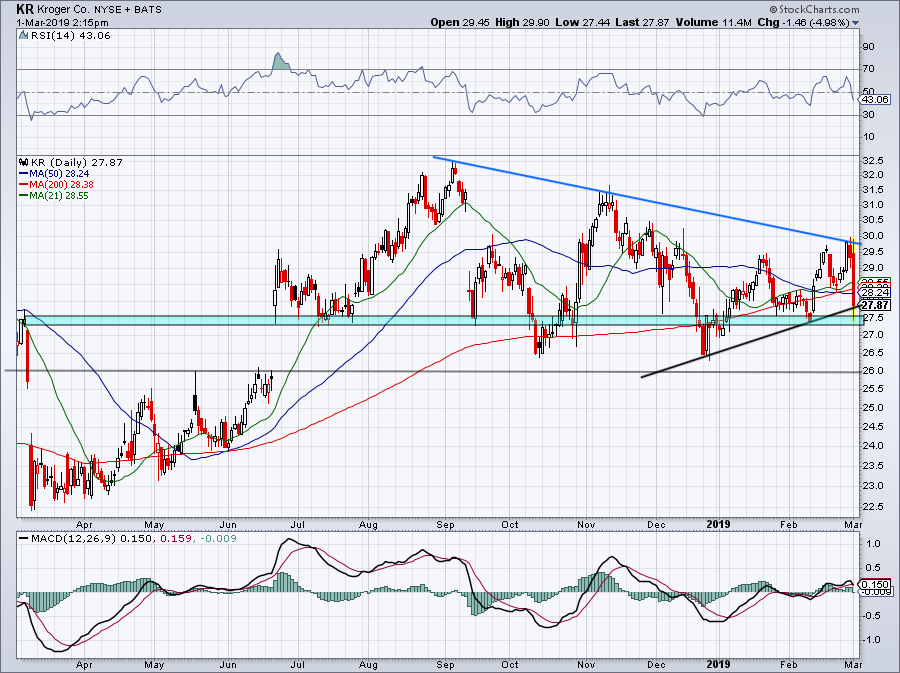

5 Top Stock Trades for Monday: TSLA, AAPL, AMZN, KR

After a strong open, bulls are trying to keep stocks higher on the day. But we continue to muddle through this area of “chop” as investors search for direction. Let’s look at some top stock trades while we’re at it.

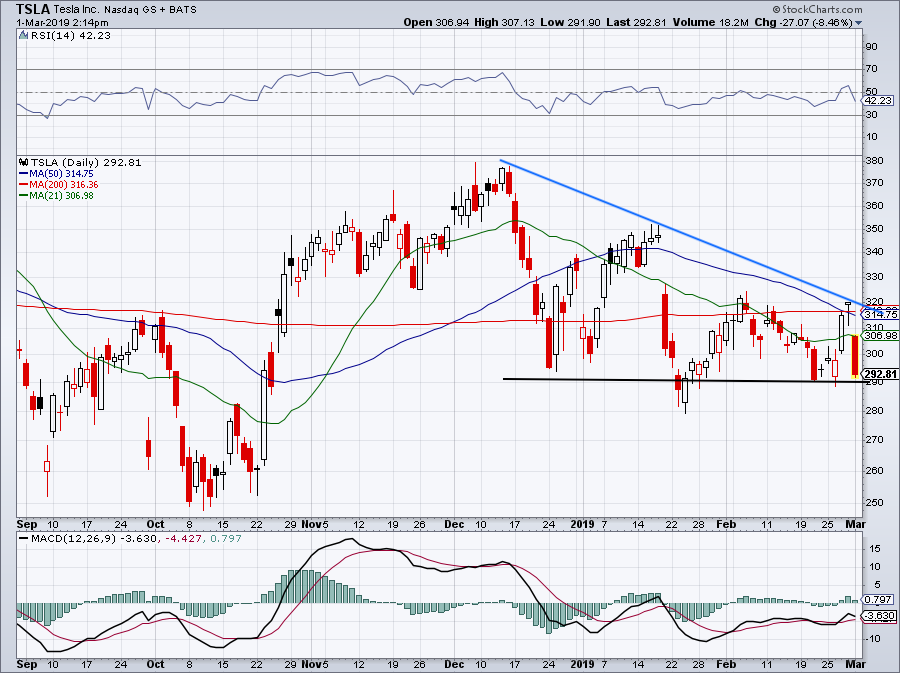

Top Stock Trades for Tomorrow #1: Tesla

Plunging more than 8% on Friday, Tesla (NASDAQ:TSLA) stock is under pressure after the company introduced its $35,000 Model 3 and said it’s unlikely to turn a profit in the first quarter.

Above is a six-month chart, a smaller timeframe than we usually use for Tesla. Below $290 and I would have some concern that support is giving way. Downtrend resistance (blue line) is clearly pressuring Tesla, and below support could spell a test of the $250 to $260 lows.

Compare Brokers

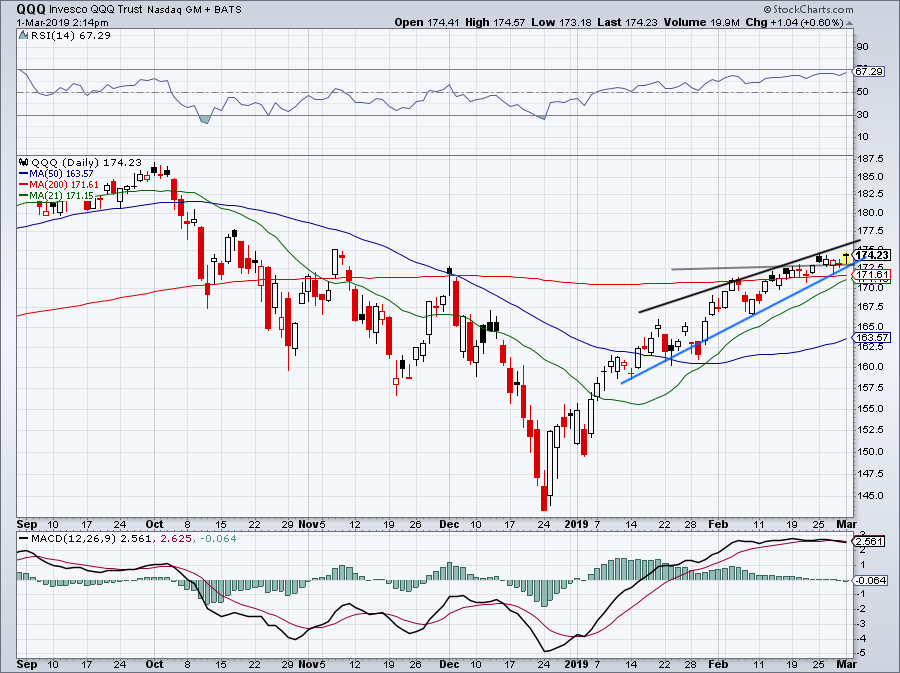

Top Stock Trades for Tomorrow #2: Nasdaq ETF

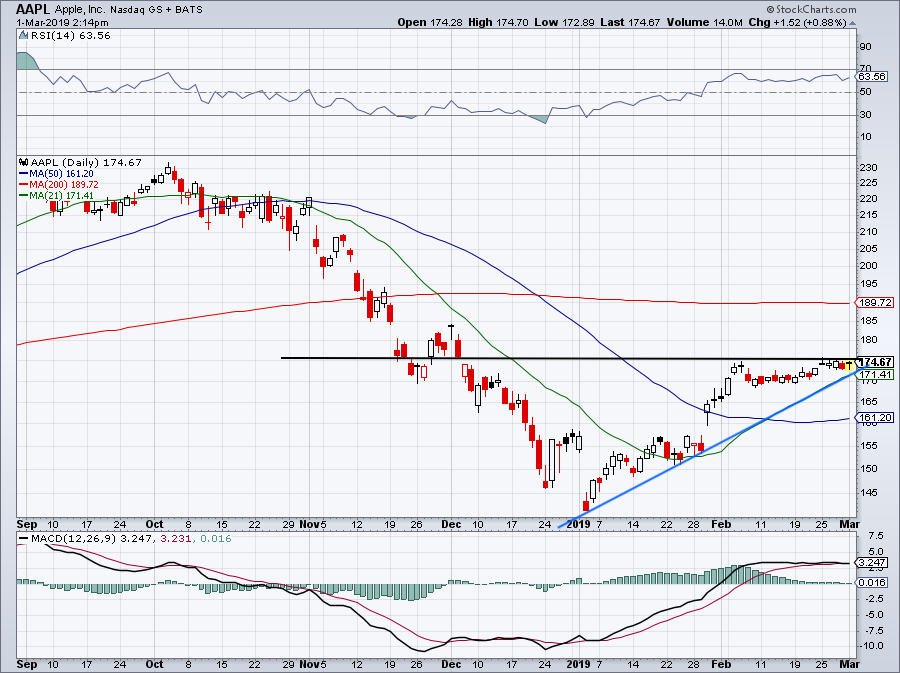

Let’s look at tech, via the PowerShares QQQ Trust ETF (NASDAQ:QQQ). Despite seemingly everyone calling for a pullback in the market, stocks have continued to gravitate higher. This tough “chop” has made it difficult for swing traders, with a number of false moves (higher and lower) frustrating a number of people.