BALTIMORE (Stockpickr) -- U.S. stocks bounced hard yesterday, the S&P 500 making its way a full percentage point higher by the time the closing bell rang. That's adding quite a bit of support for the market picture I shared on Thursday.

Yes indeed, stocks are bouncing in September, and that's creating tradable opportunities for investors right now.

That's why we're taking a technical look at five stock trades to take this week.

For the unfamiliar, technical analysis is a way for investors to quantify qualitative factors, such as investor psychology, based on a stock's price action and trends. Once the domain of cloistered trading teams on Wall Street, technicals can help top traders make consistently profitable trades and can aid fundamental investors in better planning their stock execution.

So, without further ado, let's take a look at five technical setups worth trading now.

CGG Veritas

First up is French oil service firm CGG Veritas (CGG)

. The Eurozone-based energy stock hasn't exactly posted blockbuster performance in 2013, but investors who ignore CGG for the final stretch of the year could be making a big mistake. That's because of a bullish technical pattern that's emerging in shares right now.

CGG spent most of the last eight months looking anything but bullish. But an ascending triangle pattern is changing that. The pattern is formed by horizontal resistance to the upside at $26, and uptrending support to the below shares. Basically, as CGG bounces in between those two technical levels, it's getting squeezed closer and closer to a breakout above $26. When that happens, traders have a buy signal.

The ascending triangle pattern in CGG Veritas isn't exactly textbook. That's because the setup is forming at the bottom of a downtrend, rather than in the middle of an uptrend – but it's a mistake to get caught up on the textbook pictures of what trading patterns are supposed to look like. On a move through $26, the trading implications are just as actionable.

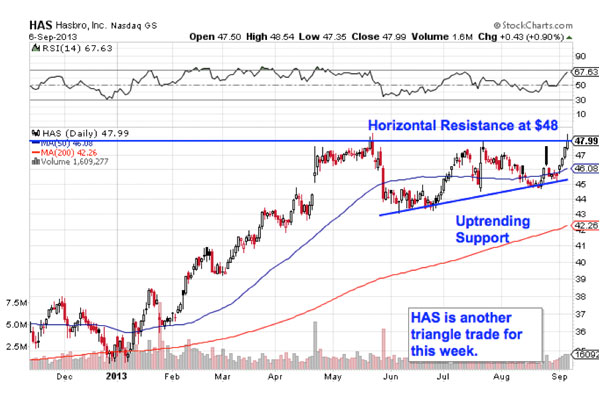

Hasbro

We're seeing the exact same setup in shares of toymaker Hasbro (HAS) right now. Like CGG, Hasbro has a horizontal resistance level above shares – at $48 in this case – and uptrending support to the downside. The key difference here is that Hasbro's triangle is more conventional than the one in the French oil stock. A breakout above $48 is the signal to become a buyer.

Whenever you're looking at any technical price pattern, it's critical to think in terms of buyers and sellers. Triangles and other price pattern names are a good quick way to explain what's going on in this stock, but they're not the reason it's tradable – instead, it all comes down to supply and demand for shares.

That resistance line at $48 is a price where there's an excess of supply of shares; in other words, it's a place where sellers have been more eager to take recent gains and sell their shares than buyers have been to buy. That's what makes the move above it so significant – a breakout indicates that buyers are finally strong enough to absorb all of the excess supply above that price level. Wait for that signal to happen before you jump into this stock, then it makes sense to put a protective stop in place at the 50-day moving average.

Top 5 Safest Stocks To Own Right Now

Bank of New York Mellon

You don't have to be an expert technical analyst to figure out what's going on in shares of Bank of New York Mellon (BK) -- the $35 billion financial services firm is in a textbook uptrend. That's about as simple as a technical pattern gets...

BNY Mellon has had its price action bounded by trendline support to the downside, bouncing higher each of the last seven times it's been tested. That uptrending channel provides a high-probability range for price action on the way up -- and while you want to be a buyer in an uptrend, the ideal time to buy comes on a bounce off of support.

Buying off a support bounce makes sense for two big reasons: it's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong). If you decide to buy BK on today's bounce, keep a protective stop on the other side of the trendline.

Lincoln National

Lincoln National (LNC) is a financial stock that's forming a channel of its own... But with a twist.

That's because the $12 billion wealth management firm is moving sideways in a range-bound trade called a rectangle. The setup gets its name because price action is essentially "boxed-in" by resistance above shares at $45, and support to the downside at $42. Instead of buying within the channel, rectangles are breakout trades – you want to trade this name when it breaks outside of the box.

That means that a move through the $45 level is a buy signal, and a move through support at $42 is an indicator that it's time to sell (or short) LNC. Right now, there's some extra bias to the upside – typically, rectangles are continuation patterns, and since Lincoln's preceding price action was up, it's likely next move is up as well. Still, it doesn't become a high probability trade until the breakout happens, so wait to get your direction from the market.

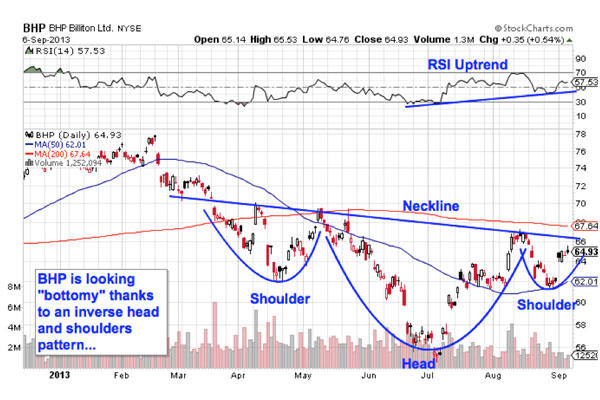

BHP Billiton

Last up is BHP Billiton (BHP), the ore giant from down under. BHP has been selling off over the course of 2013, down 15% at the same time that the broad market has managed to rally around 17% in the other direction. For portfolio managers whose performance is based on a benchmark, BHP has been a portfolio drag all year long. But that could be about to change...

Right now, BHP Billiton is forming an inverse head and shoulders setup, a bullish reversal pattern that indicates exhaustion among sellers. The inverse head and shoulders is formed by two swing lows that bottom out at approximately the same price level (the shoulders), separated by a deeper swing low (the head). The buy signal comes when shares push through the neckline that's acted as resistance over the course of the pattern. Since this setup has been forming in the long-term, the upside implications are long-term once it triggers...

Momentum adds some confirmation to this trade – 14-day RSI has been in an uptrend since the middle of the summer when BHP's price action was still chugging lower. A move through the neckline in September means that upside looks likely...

To see this week's trades in action, check out the Technical Setups for the Week portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>5 Tech Stocks Spiking on Big Volume

>>5 Stocks Setting Up to Break Out

>>4 Red-Flag Stocks to Sell This Fall

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation. Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment