[ Enlarge Image ]

[ Enlarge Image ]-FFO Growth Rate Per Share: 18%

-Dividend Growth Rate Per Share: 16%

-Current Dividend Yield: 5.5%

-Credit Rating: BBB

Digital Realty Trust appears to offer a compelling combination of dividend yield and dividend growth. There exists some drama regarding differing opinions about the future of the REIT and accounting disagreements, which has brought the price down considerably.

OverviewDigital Realty Trust, Inc. (NYSE: DLR) is a large Real Estate Investment Trust (REIT) that focuses on data centers.

Digital Realty provides a number of services, including turn-key modular data center solutions (accounting for 57% of DLR's rent income) where Digital Realty does practically all of the work, or powered-base buildings (accounting for 32% of DLR's rent income) where they focus on the real estate, shell, and electrical/mechanical aspects while the client company focuses on the critical data center aspects. Smaller aspects of the business contribute the remaining revenue.

In terms of geography, Digital Realty Trust has over 120 properties which are leased out to over 600 tenants. The properties are placed in high population states across the United States, as well as several countries in Europe, plus Australia, Hong Kong, and Singapore. Currently, 80% of revenue comes from North America, 18% from Europe, and 2% from Asia.

The tenants are from a number of industries:

29% IT Services

27% Telecom Providers

19% Financial Services

25% Other Corporate Enterprises

The top ten tenants represent about one third of total rent for Digital Realty, with the largest tenant, CenturyLink, representing about 9% of total rent.

Data center shells have a life expectancy of 40-50 years, while the electrical and mechanical systems are far more expensive per square foot and have life expectancies of onl! y 25 and 35 years respectively.

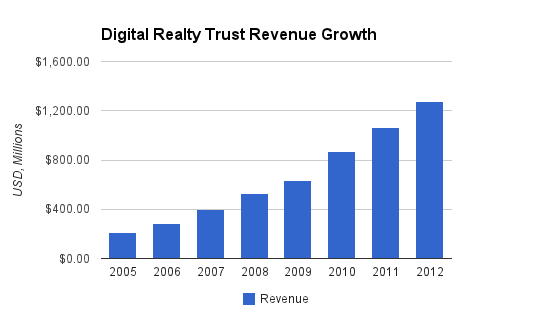

Revenue

[ Enlarge Image ]

[ Enlarge Image ](Chart Source: DividendMonk.com)

Revenue growth over this period was about 29.5% per year on average, which is explosive. To get that kind of growth, however, Digital Realty continually issues new shares to bring in new equity and expand its base of outstanding shares, so the number of shares outstanding increased by about fivefold over that period.

The rate of revenue growth per share over this time is highly dependent on which time period is used, because a huge relative increase in the number of shares occurred during 2005-2007 and then relaxed to a lower expansion rate. So, the seven year annual revenue growth rate per share (2005-2012) is only 3.4%, but the five year annual revenue growth rate per share (2007-2012) is nearly 12%, and the three year annual revenue growth rate per share (2009-2012) is 10%.

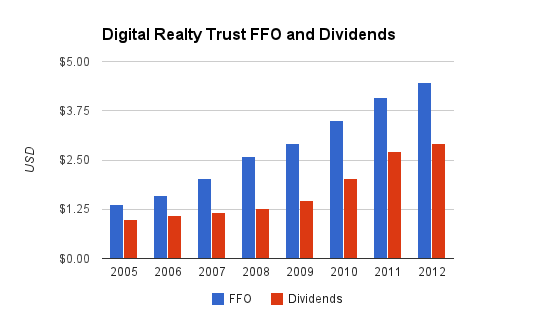

FFO and Dividends

[ Enlarge Image ]

[ Enlarge Image ](Chart Source: DividendMonk.com)

The FFO growth rate per share over this period was over 18% per year, while the dividend growth rate was over 16% per year. The FFO and dividend growth going forward are going to be lower as DLR is maturing; the dividend increased by 7.3% and 6.8% per year during the previous two years respectively, and the long-term dividend growth potential is ultimately constrained by their revenue growth per share.

The current dividend yield is 5.5%.

Approximate historical dividend yield at beginning of each year:

| Current | 5.5% |

| 2013 | 4.3% |

| 2012 | 4.1% |

| 2011 | 4.1% |

| 2010 | 3.5% |

| 2009 | 4.3% |

| 2008 | 3.5% |

| 2007 | 3.3% |

| 2006 | 4.! 5% |

Balance SheetDigital Realty currently has BBB credit ratings. The total debt/equity ratio is 1.4x, and the interest coverage ratio is about 4.4x.

Investment ThesisData usage continues to explode in volume. Corporate data, social networking, trading platforms, and online retail continue to grow, and telecom services are supplying ever greater numbers of data contracts rather than just cellular phone service. Meanwhile, cloud computing has shifted from being a buzz word to being more and more of the status quo, which means more applications are shifting towards servers and away from clients.

Cisco currently has an estimate for 29% compounded annual global IP traffic growth per year between 2011 and 2016, which means a three or fourfold increase in traffic over a five year period.

In addition, the International Data Corporation's Worldwide Data Census expects 18% of data centers to be outsourced in 2017, which is nearly a doubling of the current (2013) figure of 10%.

Putting the two projections together, the industry is looking at a multifold increase in global data usage and then a doubling of the percentage of data centers that are outsourced. Digital Realty Trust, being by far the largest at what it does, is poised to continue to capture a healthy chunk of this growth.

RisksDLR's data center properties are more specific and technical than many other REITs, so while they may be geographically diversified, they are heavily focused on a few industries, as described in the overview section.

A few months ago, Jon Jacobson gave a damning opinion of the REIT, calling DLR a short opportunity. The varied arguments were that it's a commodity (no moat) business, the fundamentals are deteriorating, and larger cloud-based competitors like Amazon, Microsoft, or Google can move in as essentially unstoppable larger competitors. The most specific argument was that the REIT substantially understates its real capital expenditures, and when his est! imate for! the capital expenditures is factored in, then FFO and therefore the fair value is substantially lower than the current trading price.

On the other hand, Gary Brode from Silver Arrow presented a bullish case for the REIT, and countered Jacobson's short thesis. He provided opposing arguments for some of the arguments that it's a short, such as stating that Amazon, Microsoft, and Google are not really direct competitors, and pointing out that the estimate for higher capital expenditures is based on faulty assumptions, and that the REIT is in fact properly reporting its real capital expenditures on its income statement.

Conclusion and ValuationI decided to publish a report at this time due to last week's earnings release. DLR reported a fair quarter, but dropped in stock price from nearly $64/share to under $57/share, and this is coming after previous drops in price that once priced shares at nearly $80. Overall, DLR shares have underperformed the market during the 2010-2013 period.

This quarterly drop seems to be primarily based on an accounting change, which may be affecting qualitative opinions much more than quantitative opinions. In other words, an accounting change following the Jacobson criticism of their accounting is spooky to some investors, and it resulted in a drop in price.

Investors will have to decide for themselves if the fundamentals of the company appear sound. The industry that this REIT operates in is a quicker-moving one than the typical REIT, so rewards and risks are amplified. Some opinions are that this is a classic example of a falling knife, while others view it as a strong value opportunity.

Applying the Gordon Growth Model with a 10% discount rate (target rate of return), DLR would have to produce compounded 4.5% annual dividend growth for the foreseeable future to make the current price of $57 fair, which is comfortably below the current revenue growth per share rate and the most recent dividend increase of 6.3%.

Therefore, the cu! rrent pri! ce appears to offer a reasonable safety margin for some impact of accounting questions, industry commoditization, or large cloud competitors that short proponents cite as issues, if one is bullish about the industry and believes the fundamentals to be sound.

To increase the margin of safety further, another way to enter a position with DLR is to sell put options at a strike price of $55 for January 2014. As of this writing, this would result in entering the stock at a cost basis of $50.60 if the shares are assigned, or obtaining an 8+% rate of return from premiums over a five-and-a-half month period if they're not assigned.

Either way, investors interested in exposure to this industry may find Digital Realty at this price to be worth looking further into to see if their view of the fundamentals matches some of the more bullish arguments.

Full Disclosure: As of this writing, I have no position in DLR.

No comments:

Post a Comment